Choosing the right formula for your home loan is not always based on a financial calculation, as the latest ING International Survey (IIS) on Home and Mortgages (June 2016) confirms.

In Luxembourg, 39% of foreign residents would choose a fixed rate if they took out a loan today, compared to 32% of national residents. Historically, Luxembourg nationals have always preferred home loans based on variable rates. This begs the question: is one better than the other?

Very low interest rates

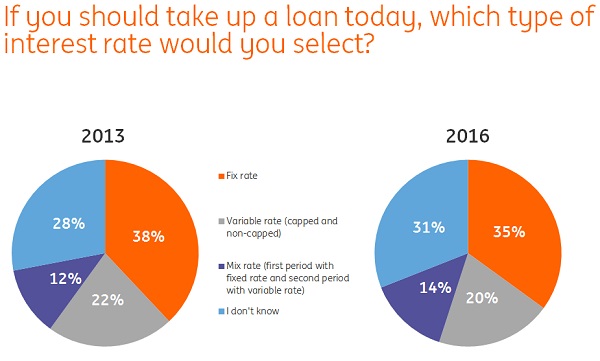

I assume you have noticed the very low level of current interest rates. 21% of Luxembourg residents believe the fall in interest rates has had a positive effect on their housing situation. In January 2016, fixed and variable rates were at the same level. Borrowers might want to take advantage of this and lock in a very low fixed interest rate for the duration of their home loan, right? Surprisingly, the results of the IIS show a very different picture: when asked what rate they would choose if they were to take out a loan in June 2016, the preferences of Luxembourg residents were almost the same as in 2013, a time when interest rates were 2 to 3 times higher than today!

In this light, it comes as no surprise that almost 1 in 3 Luxembourg residents state that they don’t really know what they should do. However, this might actually be good news in disguise, considering that the interest rate is only one of many components of a home loan. At ING, we often refer to a home loan as a “complex product”: many variations are possible and one size does not fit all.

Big-picture approach

The interest rate, paired with the principal amount and the duration of the home loan, dictates the repayment instalments. Your ability to generate revenue determine your capacity to make good on those instalments. It is crucial for the bank to understand how you plan to repay the loan in order to design the best proposal: will you repay it using your monthly salary? Or using the rent you collect from another property? The creditor also needs to know whether you plan to repay the loan in part or in full at the end of the credit term or earlier than expected, for example because you expect an inheritance or you will sell the property once you move back to your home country. In many cases, the ideal choice is neither black nor white (fixed vs. variable rate) but rather a combination of both. Such a solution allows for a certain level of lending flexibility all the while benefiting from the advantages both interest rates offer.

These and other factors of your life that might not seem directly related to your housing situation are key when taking out a home loan. It is no wonder that 35% of IIS respondents stated that their biggest worry when applying for a home loan was making the right choice between different offers. So make sure you receive relevant advice from your banker, explain your plans and do not be afraid to ask questions! The 2016 SNL Home & Living fair currently held at the Luxexpo is a great opportunity to test your knowledge – whether you are looking to buy or not. We would be happy to welcome you in our mobile branch in Hall 9 until Sunday, 23 October!

Get ready – save up!

Your first studio; a larger apartment with your partner; a house with a garden where your kids can play, your pets can roam and you can receive guests; an apartment in the suburbs now that the kids are all grown up; a holiday residence… Most of us have a housing-related dream or next step in mind. When asked what they were doing in order to be able to buy a house in the near future, 45% of Luxembourg residents replied that they were “saving money for a deposit”. This is actually a great strategy. If you already own some property, the proceeds from the sale can help with the deposit but chances are you sell to buy something bigger/better and, therefore, more expensive. We recommend you build your wealth steadily with intelligent financial products such as our Invest Plan (remember, interest rates are currently so low that traditional savings accounts yield next to nothing!).

And just so you know: buying in Luxembourg still seems to be a good idea, with 78% of IIS respondents expecting prices to continue to rise over the next 12 months!