STATEC Hedonic Index of Apartment Sale Prices (12-Month Rate of Change);

Credit: Publicité Foncière, calculs STATEC (2010-2025)

STATEC Hedonic Index of Apartment Sale Prices (12-Month Rate of Change);

Credit: Publicité Foncière, calculs STATEC (2010-2025)

On Thursday 18 December 2025, Luxembourg’s Housing Observatory and STATEC published their 20th analytical report, presenting an overview of developments in residential real estate activity, sale prices and advertised rents during the third quarter (Q3) of 2025.

The report noted that, following a very strong rebound in activity in Q2 2025, driven largely by buyers seeking to benefit from temporary tax measures before their expiry at the end of June, activity on the property and land markets slowed in Q3 2025. Nevertheless, the overall level of transactions remained relatively high, reflecting signs of a broader market recovery beyond the impact of fiscal incentives.

Number of housing sales

After the sharp acceleration observed in Q2 2025, activity eased in Q3 2025 as the temporary tax advantages expired. Some transactions recorded during the quarter still related to purchases made under the fiscal measures, as the government had extended the deadline for signing notarial deeds until 30 September 2025.

On the existing housing market, transaction volumes returned to levels close to pre-crisis standards. A total of 1,052 existing apartment sales were recorded in Q3 2025, compared with an average of 1,081 transactions in the third quarter over the 2017-2021 period. Year-on-year, transactions increased by 5.6% for existing apartments and by 27.7% for existing houses compared with Q3 2024.

Activity in the off-plan apartment segment (VEFA) continued to recover strongly, with transactions up 125% compared with Q3 2024. Despite this growth, sales in this segment remained well below pre-crisis levels, with 324 transactions recorded, roughly half the average number observed between 2017 and 2021.

Real estate prices

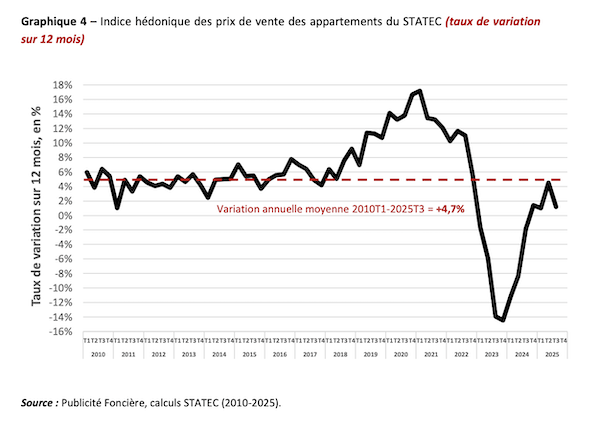

After the strong price increase recorded in Q2 2025, residential property prices declined in Q3 2025. The hedonic index of housing sale prices published by STATEC fell by 3.1% over the quarter, a decrease observed across all market segments.

Despite this quarterly correction, prices remained on an upward trend over twelve months. The aggregated housing price index increased by 1.2% between Q3 2024 and Q3 2025. Over the same period, prices rose by 0.7% for existing apartments, by 1.1% for existing houses and by 2.8% for apartments under construction.

The report suggested that the price decline in Q3 2025 may reflect a mechanical adjustment following the surge in activity linked to the expiry of tax measures, as some buyers had accepted higher prices earlier in the year to secure transactions before the fiscal deadline.

Advertised rents

Advertised apartment rents increased over the quarter, rising by 1.9% compared with Q2 2025. Over twelve months, however, the increase remained moderate, at 1.2% compared with Q3 2024. By comparison, consumer price inflation rose by 2.4% over the same period.

Rents for furnished rooms, which currently account for around 18% of the rental market, increased by 2.3% year-on-year.

For sitting tenants, rent increases during ongoing leases were also moderate. According to STATEC, the rent index rose by 1.4% between Q3 2024 and Q3 2025, broadly in line with the increase in advertised rents but below consumer price inflation.

The report is based on data collected by STATEC and the Housing Observatory, in collaboration with the Registration Duties, Estates and VAT Authority (AED), on housing activity and sales prices derived from notarial deeds. It also uses data provided by the real estate portal Immotop.lu on advertised housing rents based on property listings.