Credit: MFIN

Credit: MFIN

On Friday 16 July 2021, during a joint meeting of the Finance and Budget Committee and the Budget Execution Control Committee, Luxembourg's Minister of Finance, Pierre Gramegna, provided an update on the State's financial situation for the first half of the year.

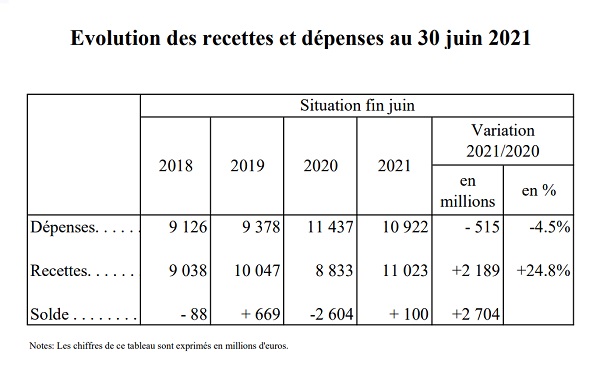

The Finance Minister noted: “The figures observed on 30 June confirm that the normalisation of economic life in Luxembourg is indeed underway, despite the uncertainties surrounding the evolution of the pandemic, which call for caution. Revenue collected by the State now stands at €11 billion, or + 24.8% more than in the first half of 2020, [which was] strongly marked by the pandemic. A comparison with the same period in 2019, a period not affected by the crisis, shows an increase of + 10%, i.e. + 5% on an annual basis, which means that Luxembourg has managed to resume the pace of growth of pre-crisis revenue”.

More specifically, revenue collected by the administration of direct contributions (Administration des contributions directes - ACD) amounted to around €5.2 billion, which represents an increase of €827 million, or 18.9%, over one year. Compared to the same period in 2019, ACD's total revenues increased by 6.5%. This positive trend is mainly attributed to the good performance of the labour market, which has contributed to the significant increase in income from tax withheld from wages and salaries.

Revenue collected by the administration of registration, domains and VAT (Administration de l'enregistrement, des domaines et de la TVA) in the first half of 2021 amounted to €3.3 billion, an increase of €871 million, or 35.9%, compared to the previous fiscal year. This represents an increase of 21.5% compared to 2019, which confirms the strong recovery in consumption following the lifting of most health restrictions during the first half of 2021.

As of 30 June 2021, revenue collected by the Customs and Excise Agency (Administration des douanes et accises - ADA) amounted to nearly €852 million, an increase of €134 million, or 18.7%, compared to the year before. Compared to 2019, revenue increased by just 0.7%. This situation is largely explained by the significant drop in fuel sales (- 22% for diesel and - 18% for petrol) compared to 2019, which has contributed positively to the achievement of reduction targets in terms of greenhouse gas emissions.

Minister Pierre Gramegna added: "Even if State revenue is moving in the right direction, the expenditure linked to the crisis, although decreasing, remains substantial, given the fact that the government is pursuing its policy of support and stimulus in favour of the national economy, with the aim of stemming the effects of the health crisis, by preserving employment and household purchasing power. The 'V'[-shaped] economic recovery which is currently taking shape reflects its success”.

In the first half of the year, government expenditure amounted to €10.9 billion of the budget voted for 2021. Compared to the previous year. spending decreased by 4.5%, which is explained in particular by the now more limited use of certain financial aid measures, including short-time working, in the context of economic recovery. Compared to 2019, however, spending increased by 16%, in line with the ambitious investment policy pursued by the government.

As of 30 June 2021, revenues had thus increased while expenditure had decreased, resulting in a positive jaws effect and making it possible to bring the central government balance back to a more or less balanced situation, with a surplus of €100 million according to the European System of Accounts (ESA 2010); the balance for the whole year was estimated at -€2.1 billion in the 2021 stability and growth programme. According to the rules of national accounts, the state deficit on 30 June 2021 amounted to -€894 million, compared to a deficit of €-2.4 billion budgeted for the entire year.

However, it is too early to draw conclusions for the year 2021 as a whole. Minister Pierre Gramegna emphasised: "While the situation of public finances continues to improve, we must not lose sight of the fact that substantial expenditure is still planned, on the one hand to support companies on the road to recovery, on the other hand to continue to invest in our infrastructures and meet the challenges of the future. In addition, faced with the rise of new variants of the virus, the extent of the recovery remains uncertain and caution therefore remains in order. Finally, the government has just set up an envelope of €50 million to repair the damage caused by the recent torrential rains, which are a natural disaster, by definition not budgeted for".

Public debt stood at €17.9 billion as of 30 June 2021, which corresponds to a ratio of 25.9% of GDP. This decrease compared to the previous month is explained by the combined effect of two factors, namely an upward revision of growth estimated for 2021, from 4% to 6% of GDP, following the new macroeconomic forecasts published by STATEC, as well as the early repayment of loans, up to €443 million, made possible by the favourable development of the State's liquidity. Luxembourg's public debt thus continues to be at a level well below the 30% of GDP mark set in the government programme and remains among the lowest in the euro zone.