Credit: BCE via STATEC

Credit: BCE via STATEC

On Tuesday 27 May 2025, Luxembourg’s national statistics institute, STATEC, published its Conjoncture Flash May 2025 report, noting a modest strengthening of economic activity in the eurozone in the first quarter, followed by signs of slowing momentum in the services sector in the second quarter, including in Luxembourg.

STATEC reported that eurozone GDP grew by 0.3% in the first quarter of 2025, up from 0.2% in the previous quarter. Among the main economies, Spain remained one of the most dynamic (+0.6%), supported by both domestic and external demand. Germany recorded its strongest growth in over two years (+0.4%), driven mainly by exports particularly to the US, improved household consumption and investment. Italy saw GDP growth of 0.3%, supported by agriculture and industry, while France posted a modest rebound of 0.1%, largely due to inventory build-up amid weak household consumption, declining investment and lower exports.

According to STATEC, this decline stems from the services sector, which particularly reflects weak domestic demand. The loss of momentum in services has also been observed in Luxembourg, where business confidence slightly decreased between February and April (remaining stable in May), with less optimistic views on company health and demand prospects, especially in business services.

STATEC noted that, by contrast, sentiment among industrial players has tended to improve. The corresponding eurozone activity index from the PMI survey increased for the fifth consecutive month in May, while industrial confidence in Luxembourg remained broadly stable over the same period. The press release accompanying the May results indicated that the introduction of new US tariffs – set at “only” 10% for EU countries until Tuesday 8 July 2025 – may have supported industrial activity. However, developments in this area remain uncertain: in yet another policy reversal, President Trump threatened on Friday 23 May 2025 to raise US tariffs on European goods to 50% from Sunday 1 June 2025, before pushing the deadline back to Wednesday 9 July 2025 two days later to allow room for possible negotiations.

STATEC also noted that confidence is slightly rising in the construction sector. Since the beginning of the year, the proportion of companies reporting insufficient order books has declined, while it had been increasing continuously until the end of 2024.

According to STATEC, the decline in key interest rates has led to continued reductions in borrowing costs for both businesses and households in Luxembourg. In March 2025, the interest rate stood at 3.8% for variable-rate mortgage loans (down 1.1 percentage points year-on-year), 4.0% for new consumer loans (down 0.5 percentage points) and 3.1% for loans to businesses (also down 0.5 percentage points). The fixed rate on new mortgage loans rose slightly in the first quarter (+0.2 percentage points between December 2024 and March 2025, -0.2 percentage points year-on-year), driven by an increase in long-term rates in the eurozone.

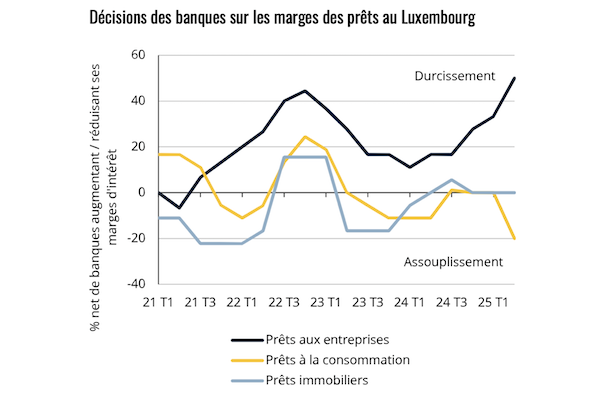

STATEC also noted that banks eased general conditions for consumer credit in the first quarter of 2025, as reported in the bank lending survey. This easing was mainly due to lower interest rates and narrower loan margins. Conditions for mortgage loans remained unchanged, after being eased in the last quarter of 2024 through extended contract durations. By contrast, lending criteria and conditions for businesses were further tightened, particularly regarding margins and non-interest-related fees, due to weaker economic prospects, increased risks related to required collateral and higher capital costs.

Tourism in Luxembourg saw strong growth in 2024, with the number of arrivals at accommodation establishments increasing by nearly 7%, compared to just 2% across the eurozone. For the first time, Luxembourg surpassed 1.5 million visitors in a single year, STATEC reported.

Although the first quarter is not typically the busiest period for tourism, the positive trend appears to be continuing in 2025. Arrivals in Luxembourg rose by 7.3% year-on-year during the first quarter, in contrast to a 0.3% decline in the eurozone. Overnight stays also increased by nearly 10%, indicating a slight rise in the average length of stay.

Regarding inflation, STATEC noted that in early 2025, as throughout 2024, inflation in Luxembourg remained below the eurozone average - 1.7% compared to 2.3% over the first four months of the year - for eight out of twelve divisions of the consumer price index. Price increases were more moderate in Luxembourg for “miscellaneous goods and services,” restaurants and hotels, as well as food and non-alcoholic beverages. Among the divisions with higher inflation in Luxembourg, “housing, water, electricity, gas and other fuels” stood out, mainly due to the partial removal of electricity price caps, which contributed 0.4 percentage points to overall inflation.

In the coming months, inflation in Luxembourg is expected to rise slightly, influenced by the wage indexation that took effect in May 2025. In its latest forecast, STATEC projected inflation at 1.9% for both 2025 and 2026, which is close to the European Commission’s latest projections for the eurozone (2.1% in 2025 and 1.7% in 2026).

Regarding fuel sales, STATEC reported that the downward trend observed since 2019 has continued into 2025. Over the first four months of the year, fuel sales in Luxembourg declined by nearly 4% compared to the same period in the previous year. This decrease was driven by diesel sales, which fell by more than 7%. The decline reflects both a continued reduction in the number of diesel vehicles in Luxembourg’s fleet, down by one third since 2019, and a narrowing of the price gap with neighbouring countries, largely due to the gradual increase in Luxembourg’s CO₂ tax. This narrowing has significantly contributed to the country’s climate targets, according to STATEC. For commercial diesel, the price differential has reversed, with diesel now cheaper in Belgium and France than in Luxembourg.

Petrol sales, however, rose by 6% at the beginning of the year, even though the number of petrol-only vehicles in Luxembourg has stabilised. STATEC attributed this increase primarily to the growing share of hybrid vehicles, most of which are equipped with petrol engines in addition to electric motors.