Credit: STATEC

Credit: STATEC

On Wednesday 6 August 2025, Luxembourg’s statistics institute, STATEC, published its updated inflation forecast, highlighting rising food and energy prices.

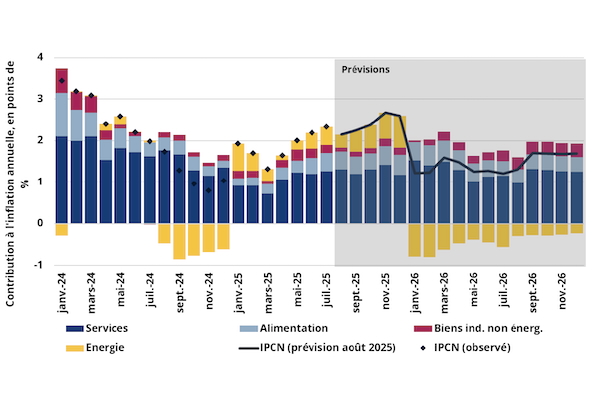

STATEC noted that consumer price growth in Luxembourg was relatively strong in the second quarter of 2025, automatically raising the inflation forecast for the current year. However, measures to stabilise electricity prices are expected to lower the forecast for 2026. The institute forecasts inflation of 2.1% for this year and 1.4% for 2026, provided that energy prices do fall and the euro remains strong. The next index adjustment is scheduled for the third quarter of 2026.

STATEC reported that annual inflation rose to 2.3% in July, its highest level in over a year. Services inflation remained at its June level (+2.4% year-on-year in July) after being sustained by wage indexation in May (+2.6%), while food inflation strengthened (+2.5% in July compared with +2.2% in June 2025) amid growing pressure on producer prices. Annual core inflation stood at +2.4% in July (compared with +2% a year earlier).

Under the influence of geopolitical tensions in the Middle East, Brent crude oil prices reversed their downward trend in the spring. Oil prices rose in June (+9% over one month), with the increase being passed on to the prices of most petroleum products in Luxembourg in July (+2.1% over one month, after +1.4% in June). This increased pressure on energy prices (+5.9% year-on-year in July, compared with +0.8% a year earlier)

Across the euro area, inflation remained stable at 2.0% according to a preliminary estimate for July (compared with 2.6% a year earlier), confirming a slowdown around the ECB's target. This apparent stability is mainly due to energy prices, which have been falling since March (-2.5% year-on-year in July), compensating for increases in other expenditure items. Food prices remain buoyant, up 3.3% year-on-year (compared with 3.1% in June), services prices posted annual inflation of 3.1% in July (after 3.3% in June) and industrial goods prices excluding energy continued to rise modestly, up 0.8% year-on-year (compared with 0.5% in June).

STATEC explained that with inflation rates falling below 1% in the last quarter of 2024, the slowdown in inflation in Luxembourg was stronger than expected. At the turn of 2025, however, the lifting of tariff shields led to an increase in gas and electricity prices, boosting annual inflation to a level close to 2% in January 2025. Following inflation of 2.1% in 2024, STATEC is forecasting inflation of 2.2% this year and 1.8% in 2026. The next indexations remain scheduled for the second quarter of 2025 and the second quarter of 2026.

In the eurozone, the main international institutions anticipate average inflation of close to 2% in 2025 and 2026. For 2025, forecasts range from 2.0% (Oxford Economics) to 2.2% (OECD). For 2026, inflation is forecast to range from 1.7% (Oxford Economics) to 2.0% (OECD), with forecasts revised downwards compared to the second quarter of 2025, largely due to the strengthening of the euro.

According to STATEC, the July 2025 projections by Oxford Economics, which feed into STATEC's current forecast, revise the assumption for the price of Brent crude oil to $70 per barrel in 2025 and $64 per barrel in 2026 (compared with $67 per barrel previously), reflecting the deterioration in the global economic outlook. Furthermore, reflecting the Trump administration's economic policy, Oxford Economics forecasts a sharp depreciation of the USD exchange rate against the EUR to $1.13/€1 in 2025 and $1.16/€1 in 2026 (compared with $1.09/€1 and $1.10/€1 previously). This depreciation would further contribute to the decline in oil prices in Europe in 2026.

The trade agreement between the EU and the United States, announced on 27 July 2025, should set a single, maximum tariff rate of 15% for US customs duties on goods originating in the European Union, half the 30% initially announced by Washington. The absence of similar retaliatory measures by the EU – the proposed surcharges on €93 billion worth of US imports having been abandoned – dispels most of the uncertainty surrounding the additional inflation that the tariff escalation could have triggered.

STATEC stated that in Luxembourg, the recent automatic wage indexation has contributed to higher service prices. Inflation is expected to rise further in the coming months, reflecting the strengthening of positive base effects on energy and, to a lesser extent, food at the end of the year. Higher-than-expected inflation in the second quarter of 2025 and a less pronounced decline in oil prices have led STATEC to revise its inflation forecast for this year to 2.1% (from 1.9% previously).

For 2026, the expected decline in oil prices and the recently announced measures on electricity prices (corresponding to a 9% decline in 2026 compared to 2025) should bring energy inflation down to -6.8% in 2026 (compared to +4.2% previously) which would result in inflation of 1.4% in 2026. Inflation in services is expected to be 2.3% in 2025 and 2.5% in 2026, while food inflation is expected to be 2.0% in 2025 before rising to 2.3% in 2026. According to these forecasts (which constitute STATEC's central scenario), the next wage indexation is still scheduled for the third quarter of 2026.