Credit: European Commission/STATEC

Credit: European Commission/STATEC

On Tuesday 19 August 2025, Luxembourg statistical institute, STATEC, published a report on the current economic conditions in the Grand Duchy and the eurozone.

STATEC reported that GDP growth in the eurozone in the first half of 2025 fluctuated sharply, driven by expectations of tighter US trade policy. Underlying trends reveal that the United States has lost some momentum. In the second quarter of 2025, euro area GDP grew by 0.1% compared with the previous quarter, showing a sharp slowdown from the first quarter’s 0.6% increase.

Challenging environment for vehicle sales

STATEC noted that in the first half of 2025, new car sales in the euro area fell by around 2.5% compared with the previous year - a decline which affected most member states, particularly Luxembourg’s neighbouring countries (-5% in Germany, -8% in France and -11% in Belgium). However, Spain, reflecting the strength of its economic activity, recorded a 14% increase in registrations over the same period. Luxembourg also saw growth but at a much more modest pace (+1%), following a weak 2024 (-5%, versus stagnation in the euro area). Both in Luxembourg and across the euro area, new registrations remain below pre-pandemic levels (approximately -15% and -20% respectively).

Commercial vehicle sales (vans, lorries and buses) also declined in the euro area, with volumes down by roughly 15% year on year in the first half of 2025. Luxembourg achieved a stronger result (+6% over the same period), although this improvement came after a particularly weak 2024 compared with the European average.

Variable-rate mortgages regain attractiveness

The STATEC report revealed that mortgage lending by Luxembourg banks rebounded strongly in the second quarter (+33% year on year, +30% compared with the first quarter). Lower interest rates, looser lending conditions and government support (some of which expired at the end of June) fuelled this increase. The rebound covered all property types (flats and houses), all borrower categories (developers and individuals) and both fixed-rate and variable-rate loans.

After three years of decline, variable-rate loans surged by nearly 50% between the first and second quarters (+25% for fixed-rate loans). By June, variable-rate mortgages accounted for 44% of new lending, compared with 34% at the end of 2024. Since May, the average variable rate has dropped slightly below the fixed rate and should continue to fall in line with cuts to policy rates. Fixed rates, which depend on long-term euro area rates, should stabilise around 3.4%. According to the bank lending survey, banks do not plan to adjust lending criteria in the third quarter, but they expect weaker demand for mortgages.

Relatively large “Green” funds in Luxembourg

STATEC’s report highlighted that since the European SFDR Regulation came into effect in March 2021, asset managers have had to disclose the sustainability risks and impacts of their investment products marketed in the EU. Funds that report taking environmental and/or social characteristics into account (Article 8 funds, or “light green”) represented 61% of Luxembourg’s UCITS assets in June 2025. Funds with a sustainable investment objective (Article 9 funds, or “dark green”) accounted for 3%. According to EFAMA, Luxembourg hosts 35% of the assets of European Article 8 funds and 54% of Article 9 funds.

More than half of Luxembourg’s green funds state a social objective and/or include climate change mitigation in their selection criteria. Morningstar data show that since the outbreak of the war in Ukraine in 2022, European Article 8 equity funds have quadrupled their exposure to defence companies, which now represent 2.5% of assets. In the second quarter, European Article 8 funds attracted €43 billion in net inflows (35% of overall EU fund flows), while Article 9 funds, which pursue an explicit sustainability objective, continued to suffer redemptions for the seventh consecutive quarter.

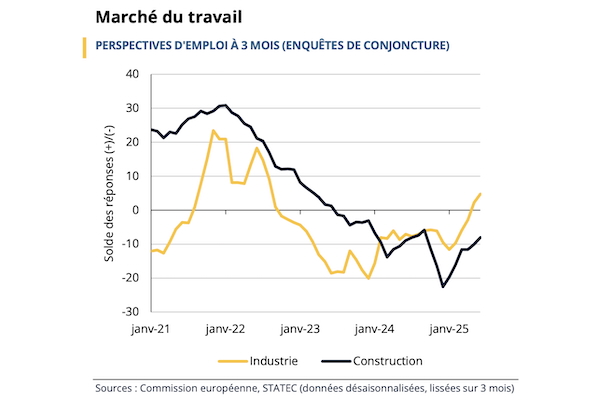

Slight Improvement in Construction Confidence

STATEC revealed that confidence in the construction sector continues to rise gradually, although it remains below its long-term average. Building activity has shown the strongest progress since the start of the year, while specialised trades have stagnated.

Order books have begun to recover despite a small dip in June and July, and the level of guaranteed activity has increased over the first half of the year. Business surveys also indicate stronger recent activity in construction since the beginning of the year. This development mainly reflects fewer firms reporting a decline in activity, with most pointing instead to stabilisation. However, weak demand still represents a major constraint, even though conditions have eased slightly in recent months (57% of firms reported it in July, compared with a peak of 66% last February). Employment prospects in the sector also show signs of improvement.

Employment Prospects Improve

The report noted that since the start of 2025, employment prospects in Luxembourg’s industry and construction sectors have improved, although they remain below their long-term average. In the euro area, hiring expectations in construction have also strengthened in recent months, while they have stabilised at a very low level in industry. In Luxembourg, industrial employment grew by 0.1% quarter on quarter in Q2 2025, following a 0.1% decline in Q1. In construction, employment still fell (-0.6% over the quarter) but at a slower pace than in previous quarters.

During the first five months of 2025, the agri-food sector made the largest positive contribution to industrial employment (+126 people compared with December 2024), followed by metallurgy, wood products and energy production and distribution (each adding around +35 people). In contrast, metal product manufacturing and machinery and equipment manufacturing recorded significant job losses (-219 and -63 people respectively). In construction, employment remained relatively stable in civil engineering but continued to decline in specialised trades (-314) and building construction (-268).

Inflation expected below 2% in Luxembourg in 2026

The report stated that the recent automatic wage indexation has pushed up service prices. Inflation should rise further in the coming months as positive base effects from energy strengthen towards the end of the year. Stronger-than-expected inflation in Q2 2025 has led STATEC to revise its forecast for this year to 2.1% (up from 1.9%).

For 2026, the expected fall in oil prices and government measures on electricity tariffs (equivalent to a 9% reduction over the year) should lower energy prices by almost 7%. This would bring headline inflation down to 1.4%. Service price inflation is projected at 2.3% in 2025 and 2.5% in 2026, while food inflation should reach 2.0% in 2025 before rising to 2.3% in 2026. The next wage indexation is scheduled for Q3 2026.

The trade agreement between the EU and the United States, announced on 27 July 2025, sets a single global maximum tariff of 15% on US duties applied to goods originating from the EU. As the EU has not announced similar retaliatory measures, the agreement removes most of the uncertainty surrounding the potential inflationary surge that an escalation of tariffs could have caused.

$250 billion of US energy for Europe?

As part of the “trade agreement” between the United States and the EU, Europe announced its intention to import $250 billion (around €215 billion) of US energy annually until 2028. This target represents more than three times the level of US energy imports recorded in 2024 (€65 billion) and over half of all European energy imports (€375 billion in 2024).

According to STATEC, reaching these objectives will prove challenging, even though imports of US liquefied natural gas (LNG) jumped by 60% in the first half of 2025, after reaching nearly €20 billion in 2024. These volumes could grow further, as the United States plans to almost double its export capacity between 2024 and 2028. Europe also has sufficient infrastructure to take in more LNG, for example to replace remaining Russian gas supplies. By contrast, prospects for higher US oil imports (€42 billion in 2024) appear limited, as American production growth should slow in response to the expected weakness in oil prices.

Moreover, it is not the EU itself but rather European companies that purchase energy and these firms cannot easily be compelled to favour US suppliers.