Credit: STATEC (forecasts as of 07/05/2025)

Credit: STATEC (forecasts as of 07/05/2025)

On Wednesday 7 May 2025, Luxembourg's statistical institute, STATEC, issued its latest inflation forecast report.

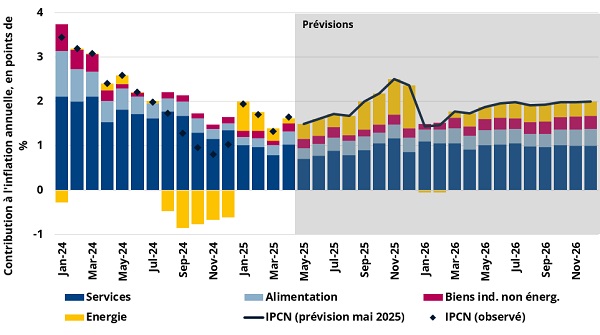

STATEC noted that inflation was relatively low in the first quarter of 2025, standing at 1.7% in April 2025. Automatic wage indexation was triggered in April 2025, leading to the payment of an index-linked tranche on 1 May 2025. Despite the international context of heightened trade tensions, STATEC forecasts inflation to be limited to 1.9% in both 2025 and 2026. The next wage indexation would therefore take place in the third quarter of 2026.

Elaborating on this, STATEC explained that the downward trend in services inflation continued In the first quarter of 2025, offset by the positive contribution of energy due to the easing of support measures on energy prices. Inflation in Luxembourg rose to 1.7% in April, driven in particular by services and food, while pressure on energy prices eased significantly. Underlying inflation stood at +2.0% in April (compared with +1.5% a month earlier).

STATEC largely attributed the price increases observed in April for services (+2.2% year-on-year, +0.9% month-on-month) and food (+1.7% year-on-year, +0.6% month-on-month) to unfavourable base effects linked to the slowdowns recorded a year earlier. By contrast, oil prices continued to fall in April, following the collapse in oil prices, posting annual inflation of -6.1%. This has significantly reduced energy inflation to 1.1% (compared with +6% on average in the first quarter of 2025). With the intensification of trade tensions linked to the Trump administration's policies in the US weighing heavily on oil markets in April 2025, the recent announcement by OPEC+ of an increase in its production, combined with the depreciation of the dollar against the euro, should continue to limit inflationary pressures on energy in Luxembourg and in the euro area in the coming months.

STATEC observed similar trends across the euro area, where inflation remained stable at 2.2% according to preliminary estimates for April (compared with 2.4% a year earlier). As in Luxembourg, inflation in services and food products has been on the rise (from +3.5% and +2.9% in March 2025 to +3.9% and +3% in April), while energy prices slowed significantly in April (-3.5% year-on-year, after -1% in March).

Despite trade tensions, the main international institutions anticipate average inflation in the eurozone of close to 2% in 2025 and 2026, according to STATEC. For 2025, forecasts range from 1.9% (Oxford Economics) to 2.3% (European Commission), slightly higher than those anticipated in the first quarter of 2025, largely due to growing economic tensions worldwide. For 2026, inflation is forecast to range from 1.8% (Oxford Economics) to 2% (OECD).

The new projections from Oxford Economics (OE), used in STATEC's inflation forecast model, highlight the uncertainties surrounding the Trump administration's policies and predict a significant depreciation of the USD exchange rate against the EUR to 1. 09 USD/EUR in 2025 and 1.10 USD/EUR in 2026 (compared with 1.04 USD/EUR and 1.06 USD/EUR previously). The assumption for the price of Brent crude has been revised downwards to USD 68 per barrel for 2025 and USD 67 per barrel in 2026 (compared with USD 73 per barrel previously). The depreciation of the dollar against the euro is expected to further ease Europe's oil bill. The contrast between upward inflationary pressures linked to a trade war and downward pressures corresponding to the risks of a global slowdown (weighing on consumption and investment) make the economic environment "exceptionally uncertain". However, price pressures in the eurozone are likely to ease as energy costs fall in line with the global economic downturn.

In Luxembourg, the recent rise in inflation led to automatic wage indexation on 1 May 2025. Inflation is expected to rise further in the coming months, reflecting both the impact of wage indexation and the strengthening of positive base effects on energy, particularly at the end of the year. Lower-than-expected inflation in the first quarter of 2025 and the sharp fall in oil prices in euros have prompted STATEC to revise its inflation forecast for this year down to 1.9% (from 2.2% in February). For next year, inflation forecasts have been revised slightly upwards to 1.9% (compared with 1.8% previously). Inflation in services is expected to stand at 1.9% in 2025 and 2.1% in 2026, while food inflation is expected to be 1.6% in 2025 before rising to 1.9% in 2026. However, energy inflation is expected to fall from 7.2% in 2025 to 4.2% in 2026, reflecting negative base effects. According to these forecasts (which constitute STATEC's central scenario), the next wage indexation would take place in the third quarter of 2026.