Nordic bank Nordea released a statement Monday claiming compliance for its activities related to offshore structures in the Grand Duchy in response to accusations in the media that its Nordea International Banking branch in Luxembourg had enabled its clients to evade tax.

The statements were issued in the wake of 11.5m files that were leaked from the database of offshore law firm, Mossack Fonseca and obtained by the German newspaper Süddeutsche Zeitung, before being shared with the International Consortium of Investigative Journalists (ICIJ), who then released the information to various international media partners.

The 2.6TB leak is said to be one of the biggest ever in journalism, far surpassing the prominent WikiLeaks scandal in 2010, the 260GB offshore secrets issue in 2013 and the 4.4GB of data on Luxembourg tax files in 2014.

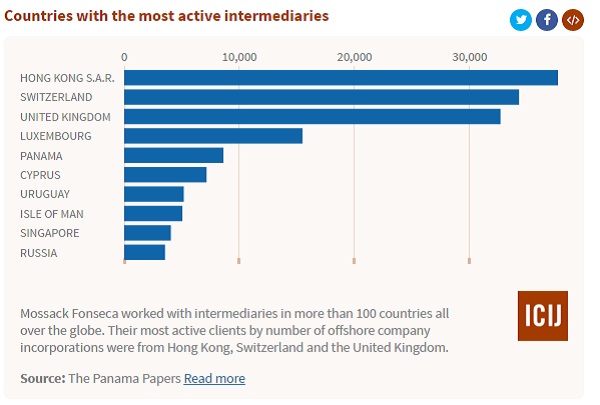

Luxembourg has once again become implicated, with the ICIJ highlighting it as one of the four European countries where offshore facilitators, providing instructions from financial intermediaries, are concentrated and listing it seventh in a list of top ten countries where intermediaries operate (405) and fourth in terms of those with the most active intermediaries, around 15,000.

Nordea has come forward to claim its strong disavowal of tax evasion. According to an official statement released by the bank, "already in the end of 2009, Nordea International Private Banking in Luxembourg took proactive measures beyond the requirements to secure all customers' holdings and incomes on their accounts were reported to the tax authorities".

"Our tax advice and ethical standard clear: we do not encourage or facilitate tax schemes of our customers that are regarded as tax evasion," commented Casper von Koskull, Group CEO. "We help our customers to pay the tax they should be reporting to the authorities. However, we regret that we didn't have these procedures already earlier."

The company went on to state that it holds "a wide range of processes to ensure that the customers declare their accounts to the tax authorities."

The data have revealed that four Luxembourg financial structures have figured in a list of 10 banks requesting the most offshore companies for clients: Banque Internationale à Luxembourg fully-owned subsidiary, Experta Corporate & Trust Services (1,659, 1st place); Banque J. Safra Sarasin - Luxembourg S.A. (963, 2nd place); Société Générale Bank & Trust Luxembourg (465, 8th place); Landsbanki Luxembourg S.A. (404, 9th place). No statement has as of yet been released by these institutions.

Graph by ICIJ