Assessment of competitive position (beyond EU);

Credit: European Commission / STATEC

Assessment of competitive position (beyond EU);

Credit: European Commission / STATEC

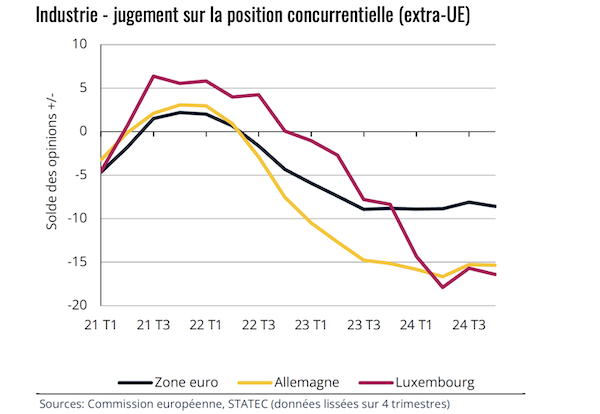

On Tuesday 21 January 2025, STATEC published a report indicating that, since 2023, European industries have faced increasing competition from non-EU countries, a trend that has also affected Luxembourg, impacting several key sectors of its industry.

The European industrial sector continues to face difficulties. Despite a slight recovery in industrial production within the eurozone in October and November 2024, output remains approximately 5% below the average level recorded in 2022. The decline in industrial production observed since 2023 can be attributed to several factors, including rising energy costs linked to the consequences of the war in Ukraine, weak construction activity in several European countries (reducing demand for industrial products from this sector) and sluggish performance in the European automotive market, which has negatively impacted car manufacturers.

STATEC added that business sentiment surveys conducted among eurozone industrialists indicate a clear deterioration in their perception of competitiveness, particularly in relation to non-EU competitors. Countries such as Germany, Luxembourg and Austria have reported the most significant declines in competitiveness, alongside notable reductions in industrial production during the same period. While this erosion of competitive positioning is also felt across the majority of other EU member states, its impact is generally less pronounced.

As noted by STATEC, Luxembourgish industrialists are particularly concerned about international competition in sectors such as machinery and equipment manufacturing, the production of IT, electronic, optical and electrical equipment (some of which is supplied to the automotive industry), rubber and plastics manufacturing, the textile industry and the chemical industry. Metal product manufacturing also experienced pressure from international competition until the end of 2023, but this trend has significantly eased since then.

Overall, the sentiment among Luxembourg’s industrialists has been improving since mid-2023, contrasting with the continued decline observed across the eurozone. However, significant month-to-month fluctuations remain, largely due to highly volatile production forecasts in the metallurgy sector.

The sentiment among Luxembourg’s non-financial services companies experienced significant volatility over the past year. Confidence improved notably in the first half of 2024, dipped during the third quarter, and has been on an upward trend since. By December 2024, the confidence indicator reached 7.4 points, the highest level since May 2022, though still below its long-term average.

This recent recovery in confidence within Luxembourg’s services sector - contrary to a general decline across the eurozone towards the end of 2024 - is primarily attributed to improved perceptions of demand, both in terms of recent developments and future expectations. STATEC reported that this positive trend has benefited several service activities, including legal and accounting services, rental services, air transport, postal and courier services and the restaurant sector.

However, other categories faced challenges towards the end of 2024, with declines recorded in areas such as land transport, warehousing and transport auxiliary services, accommodation and IT programming and consulting services.

STATEC noted that the COVID-19 pandemic, surging energy prices and rising food costs have significantly driven up prices in restaurants and cafés across the eurozone, increasing by 25% in December 2024 compared to December 2019. Luxembourg, with a 22% rise, ranks among the countries with the smallest price increases over this period, while Eastern European countries have experienced the largest hikes, exceeding 50% over the past five years.

In 2024, restaurants and cafés were among the key categories contributing to the divergence between service inflation in Luxembourg and the eurozone. This difference can partly be explained by weaker food price inflation in Luxembourg (+25% since December 2019, compared to +31% in the eurozone) and energy prices. While Luxembourg saw the steepest rise in gas prices for small businesses in the eurozone since the second half of 2019 (+130% through the first half of 2024, compared to +73% in the eurozone), electricity price increases were among the lowest for businesses consuming less than 20 MWh (+10% versus +32% in the eurozone).

Within Luxembourg, small restaurant meals experienced the highest increase (+25% since December 2019), followed by beverages in restaurants (+24%), non-alcoholic drinks in cafés (+22%) and full meals in restaurants (+21%).

Electricity tariffs for households in 2025 are expected to increase by an average of 30% due to the partial removal of the price shield introduced in late 2022. Had the shield been fully removed at the start of the year, prices would have surged by 60%. The price rise also reflects the effects of reforms in the tariff structure for network fees, which now consider both the amount of energy consumed and peak power usage. This reform aims to limit the need for expanding grid capacity as part of the energy transition by discouraging high power demand peaks.

STATEC warned that the impact of these changes will vary depending on households' electrical equipment. For an average household consuming approximately 3,900 kWh annually without an electric vehicle (EV) or heat pump, the increase will be slightly below 30%. Households equipped with a heat pump will see an increase slightly above 30%.

For those using an EV, if charging is done with an 11 kW home charging station, the increase could reach nearly 50%. However, by reducing the charging power to 3 kW, the rise could be limited to around 35%.

The full report is available (in French) at https://statistiques.public.lu/fr/actualites/2025/conjflash-01-25.html