The Luxembourg Regulatory Institute (ILR) has published a statistical report on postal services in Luxembourg in October, in which it appears that in 2022, parcel services recorded constant and sustained growth while mail services accentuated their decline with a significant decline compared to 2021.

An interactive table published on the Institute’s website allows one to consult statistical data since 2016.

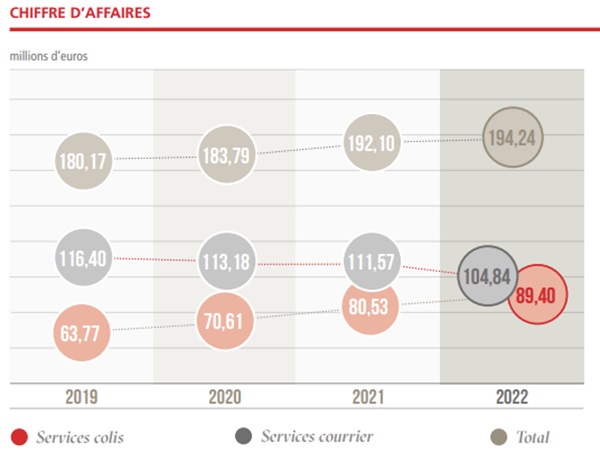

The turnover of the postal services market reached €194.24 million in 2022, up 1.1% compared to 2021. It is distributed between the turnover of mail services amounting to €104.84 million (-6.0%) and that of parcel services totalling €89.40 million (+11.0%). The share of turnover from parcel services has increased to 46.0% of the total postal sector in 2022, an increase of 10.6 points since 2019.

Mail services represent 139.76 million units, down 8.5% compared to 2021. This drop in traffic is increasing and will continue. National traffic represents 74.2% of total traffic, while recording a decline of 10.7% compared to 2021. Mail traffic marks a continued decline with a compound annual rate of -5.7% over the 2019/2022 period. The designated service provider, POST Luxembourg, processes 96.0% of total mail traffic.

Parcel services total 16.55 million units, up 7.8% compared to 2021. The growth of the parcel services market is mainly supported by the inbound cross-border services market which recorded an increase of 7.6% and with a volume of 13.24 million packages. This trend, linked to the development of “B2C” electronic commerce, is based on a compound annual growth rate of 15.9% over the period 2019/2022.

The parcel services market is significantly more dynamic than the mail services market and has 23 service providers, the nine main ones of which are: Entreprise des Postes et Télécommunications (POST Luxembourg), DHL Express (Luxembourg), United Parcel Service Luxembourg (UPS), DPD (Luxembourg), FedEx Express Luxembourg, General Logistics Systems Belgium-Succursale Luxembourg (GLS), as well as Colis Privé Belgique, Mondial Relay and Amazon Deutschland W11 Transport which have recently entered the Luxembourg market.

Furthermore, the statistical survey shows that more than 80% of parcel traffic is subcontracted, which shows its preponderant role in the provision of parcel services on the Luxembourg market.

The postal sector employs more than 2,000 people, a higher level than in 2021. POST Luxembourg employs nearly 1,300 people, or 62.0% of jobs in the sector. Three other large providers each employ more than 100 people.

Concerning access to postal services, 101 points of sale of POST Luxembourg and 102 of ten other providers are established across Luxembourg. The number of POST Luxembourg automatic distribution points (pack up) increased to 133 in 2022, or 12 more distribution points since 2021. This trend echoes the dynamism of parcel traffic.

For information purposes, the statistical report presents the situation of the postal services market, with details of mail services and parcel services, on the basis of indicators, such as turnover, volumes, jobs and quality of services provided. It covers the key figures for the postal services market for the year 2022 and their evolution since 2019. The document is based on data communicated by 35 providers active on the Luxembourg postal services market in 2022. The Institute notes that six new providers have requested their registration in the public register; two of them are among the top 10 parcel service providers.