Blederode has announced a €224 million profit for 2015, compared to €226 million in 2014; shareholder's equity per share is up 16% to €53.21, with a proposed distribution of €0.70 per share (+8%).

Brederode has stated that its result for 2015 can again be considered exceptional as it was the previous year. Both segments of activity in which the group is specialised have contributed to this success. The net performance of Private Equity is 26% and that of the listed portfolio 10%.

The excess cash generated by private equity has allowed Brederode to again strengthen its listed portfolio, for a total of €48 million. New purchases have been made of 3M and Intel shares in the USA, Relx (ex Reed Elsevier) and Rolls Royce shares in the UK and Telenor in Norway. The participations in E.ON and Saipem have been sold.

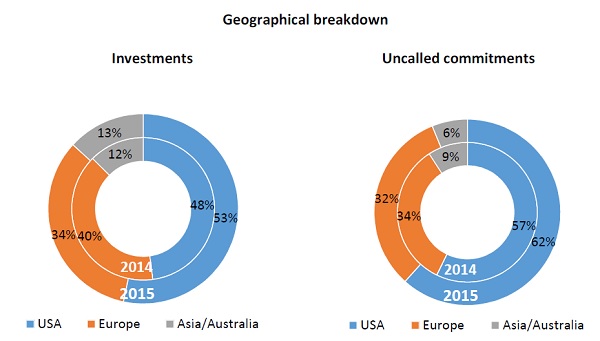

New private Equity commitments for €179.61 million have been signed, vs €209.38 million in 2014. The uncalled commitments have increased during the year to €532.1 million vs €452.89 million at 31 December 2014.

During 2015, a group subsidiary has purchased 273,861 Brederode’s shares representing 0.93% of its capital. The group owned 3.94% of the capital at year end 2015.

Brederode’s vocation to invest in equity capital will continue to subject the company to risks and uncertainties linked to the international macro environment. Even if the volatility of the financial markets can cause valuation changes relatively significant, the quality of the assets and their diversification allow the Board to be confident in the outlook of the company.