Credit: LGX

Credit: LGX

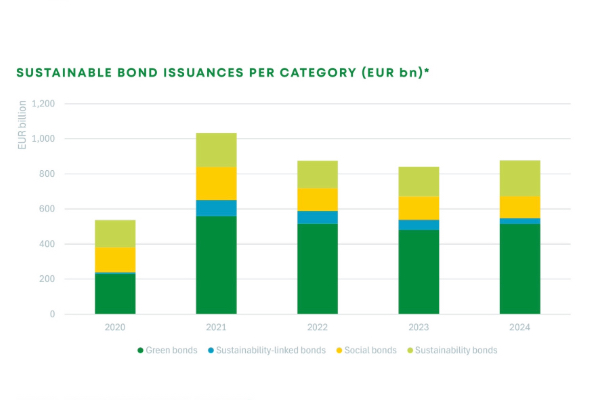

According to findings from the Luxembourg Green Exchange (LGX), the issuance of sustainable bonds reached €878 billion in 2024, surpassing 2022 and 2023 levels, and marking the second-best year for sustainable bond issuances on record.

Created by the Luxembourg Stock Exchange (LuxSE), the LGX DataHub is a centralised database of structured sustainability data on more than 18,000 sustainable bonds from 3,500+ issuers across the world, covering close to the entire universe of the world’s listed sustainable debt securities.

The LGX explained in its “Global Sustainable Bond Issuances 2024” report that there are primarily four types of sustainable bond:

- Green bond: Bond where the proceeds or an equivalent amount are exclusively used to finance or re-finance, new and/or existing eligible green projects. These remain a cornerstone of the market, funding critical environmental projects. They account for 59% of the sustainable bond market in terms of volume.

- Social bond: Bond where the proceeds, or an equivalent amount, are exclusively used to finance or re-finance new and/or existing eligible social projects. The issued amount of these bonds remained stable in 2024 compared to previous years, with Asian issuers compensating for the decreasing amount issued in other regions.

- Sustainability bond: Bond where the proceeds, or an equivalent amount, are exclusively used to finance or re-finance a combination of both green and social projects. These bonds had a strong year, with issuance volumes reaching their highest levels since the market's inception, driven by supranational issuances.

- Sustainability-linked bonds (SLB): Bond for which the financial and/or structural characteristics vary depending on whether the issuer achieves predefined sustainability objectives. These bonds continue to face challenges, with issuances decreasing at a compound annual growth rate of 32% since 2020.

On a geographical level, Europe continues to dominate the market, although its share slightly declined last year. 2024 was marked by a significant increase in the share of supranational issuers, rising from 11% of the volume in 2023 to 16% in 2024. Meanwhile, Asian issuers - notably in China, Japan and South Korea - have strengthened their market position, steadily increasing their share of the total volume issued from 12% in 2020 to 27% in 2024, effectively doubling their share of the market.

Following a record year in 2023, issuances from South America declined in 2024, accounting for 2% of the volume issued, while it accounted for 5% in 2023, thanks to large sovereign issuances of SLBs from the Republic of Chile. Sustainable bond issuances in North America remained relatively stable despite the environmental, social and governance (ESG) backlash taking place in the United States. Africa and Oceania exhibited trends consistent with those observed in the previous year, representing a small portion of the market (<2%).

Analysing issuer types, the private sector - comprising of corporates and financial entities - continues to play a pivotal role in the sustainable bond market. In 2024, this sector accounted for 57% of the total issuance volume, spanning 2,473 issuances. Notably, since 2021, private sector issuers have consistently contributed over half of the total sustainable bond issuances and volume, primarily driven by the green bond market, and to a lesser extent the SLB market.

In contrast, the private sector share remains comparatively lower in the social and sustainability bond markets. In 2024, supranational issuers were particularly active in the sustainable bond market, issuing €140 billion across 405 issuances. Meanwhile, sovereigns, quasi-sovereigns and agencies collectively issued €239 billion through 670 issuances.

Going forward, and notably to achieve the new collective quantified goal set at COP29, a unified effort to mobilise both private finance and public funding will be essential, according to LGX. Sustainable bonds, and particularly green bonds, are poised to play a pivotal role in this process. They have already proven effective in engaging corporates and attracting investor capital for environmental projects, such as transformative decarbonisation technologies. LGX said these innovative solutions will be critical enablers in accelerating the transition to a decarbonised global energy system. By driving this transition, they can help deliver on global climate goals while unlocking new opportunities for sustainable growth.

LGX also announced a new market intelligence study on the SLB market. Launching next week, this study takes an in-depth look at the SLB market, drawing on the experience of issuers, investors and LGX. LGX, along with Environmental Finance, will be hosting a web seminar on Tuesday 11 February 2025, to investigate the study's key findings. Details of this event can be found at: www.environmental-finance.com/content/webinars/latest-trends-shaping-the-global-sustainability-linked-bond-market.html