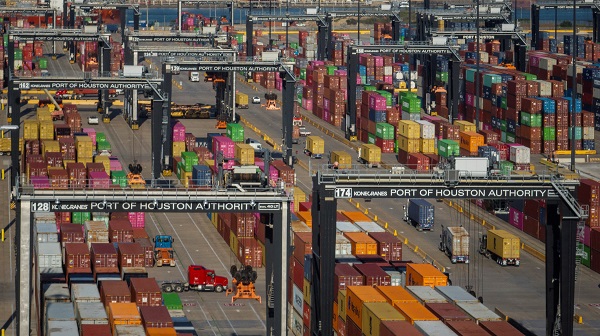

A drone view shows trucks as they transport cargo at the Bayport Container Terminal in Seabrook, Texas, US, 7 April 2025;

Credit: Reuters/Adrees Latif

A drone view shows trucks as they transport cargo at the Bayport Container Terminal in Seabrook, Texas, US, 7 April 2025;

Credit: Reuters/Adrees Latif

WASHINGTON/SINGAPORE (Reuters) - President Donald Trump's "reciprocal" tariffs on dozens of countries took effect on Wednesday 9 April 2025, including massive 104% duties on Chinese goods, deepening his global trade war and spurring more widespread selling across financial markets.

Trump's punishing tariffs have shaken a global trading order that has persisted for decades, raised fears of recession and wiped trillions of dollars off the market value of major firms.

Since Trump unveiled his tariffs last Wednesday, the S&P 500 has suffered its deepest loss since the benchmark's creation in the 1950s. It is now nearing a bear market, defined as 20% below its most recent high.

Global benchmark bonds, assets perceived as relatively safe, were also caught up in the market turmoil on Wednesday, an unnerving turn towards forced selling and a dash for the safety of cash.

European and US stock futures pointed to more pain ahead following a grim session for most of Asia. Chinese stocks held firm, however, as state support propped up the ailing market.

Trump has shrugged off the market rout and offered investors mixed signals about whether the tariffs will remain in the long term, describing them as "permanent" but also boasting that they are pressuring other leaders to ask for negotiations.

"We have a lot of countries coming in that want to make deals," he said at a White House event on Tuesday afternoon. He said at a later event that he expected China to pursue an agreement as well.

Trump's administration has scheduled talks with South Korea and Japan, two close allies and major trading partners, and Italian Prime Minister Giorgia Meloni is due to visit next week.

The deputy prime minister of Vietnam, the low-cost Asian manufacturing hub hit with some of the highest duties globally, is set to talk with Trump's Treasury Secretary Scott Bessent later on Wednesday.

The prospect of deals with other countries had pushed stock markets up earlier on Tuesday 8 April 2025, but US stocks had ceded their gains by the end of the trading day.

German Finance Minister Joerg Kukies said on Wednesday that Europe's largest economy is at risk of another recession as a result of the trade tensions. Investment bank JP Morgan estimates there is a 60% chance of the world economy entering recession by year-end.

China vows to fight

Trump nearly doubled duties on Chinese imports, which had been set at 54% last week, in response to counter-tariffs that Beijing announced last week. China has vowed to fight what it views as blackmail.

Top Chinese brokerages pledged to join efforts by Chinese state holding companies to help steady domestic share prices in response to the tariff-induced turmoil.

Central banks in New Zealand and India cut rates on Wednesday in what could presage a broader move by policymakers to try and cushion the tariff hit to their economies.

Other nations are funnelling fiscal support to key export sectors with South Korea announcing a raft of emergency measures for automakers, including tax cuts and subsidies.

Some economists have warned that ultimately US consumers are likely to bear the brunt of the trade war, facing higher prices on everything from sneakers to wine.

Nearly three-quarters of Americans expect the prices of everyday items to rise in the next six months, a new Reuters/Ipsos poll found.

The full effects of Wednesday's tariffs may not be felt for some time, as any goods already in transit as of midnight will be exempt from the new levies as long as they arrive in the US by 27 May 2025.

Trump's earlier across-the-board 10% tariffs on all imports from many countries began on Saturday 5 April 2025.

The latest round of duties, which took effect at 00:01 ET (06:01 CET), is aimed at countries that are "ripping off" the US, according to Trump.

That list includes many of the United States' closest allies, including the European Union, which was hit with a 20% tariff as well as industry-specific duties. The 27-member bloc will vote on initial counter-measures later on Wednesday.

Trump has said the tariffs are a response to barriers put on US goods and are needed to fix America's trade imbalances. He has also accused countries including Japan of devaluing their currencies to gain a trade advantage, something Tokyo denies.

Japan's finance minister on Wednesday said trade negotiations with Washington could include foreign exchange rates.

Trump has signalled he may not be finished on tariffs.

In remarks to Republican lawmakers on Tuesday evening, he said he would soon announce "major" tariffs on pharmaceutical imports, one of a handful of categories of goods that have been exempted from the new taxes.