Industrial production trends;

Credit: Eurostat

Industrial production trends;

Credit: Eurostat

According to STATEC, economic activity rebounded strongly across the euro area in the third quarter of 2020 - and Luxembourg is set to be no exception.

Whilst STATEC reported promising projections for the third quarter in Luxembourg, the outlook for the end of the year is less encouraging, as the rise in coronavirus infections is accompanied by new restrictions, even if these are expected to weigh less on activity than in spring.

In the third quarter of 2020, real GDP in the euro area grew by almost 13% over one quarter, after a marked recession in the two previous quarters (down 4% in the first and down 12% in the second quarters of 2020). STATEC attributed this recovery mainly to the lifting of lockdown measures, as well as measures to support economic activitiy and absorb the negative consequences of the COVID-19 pandemic in the labour market. For Luxembourg, the trend drawn by most economic indicators also suggests a firm upturn in activity in the third quarter.

The outlook is much more mixed for the end of the year, again for reasons related to the evolution of the pandemic. COVID-19 infections were on the rise again in Europe last month, putting pressure on health structures and staff. In Luxembourg, activity restrictions had hitherto been relatively limited compared to other countries, but the maintenance of infections at a high level and the number of hospitalisations recently led the government to restrict certain activities again.

Nevertheless, there have also been several positive developments. News of the imminent arrival of effective vaccines have been favourably received on the stock exchanges, which is always a positive sign for the Luxembourg financial sector, although it remains to be seen how they will translate into the expectations of businesses and households. In addition, the new lockdown measures implemented in Europe, including Luxembourg, are much less restrictive than those in spring. The measures concern fewer economic branches and schools have remained open. Similarly, whilst the number of new infections remains high at the end of November, they have tended to decline recently in several countries.

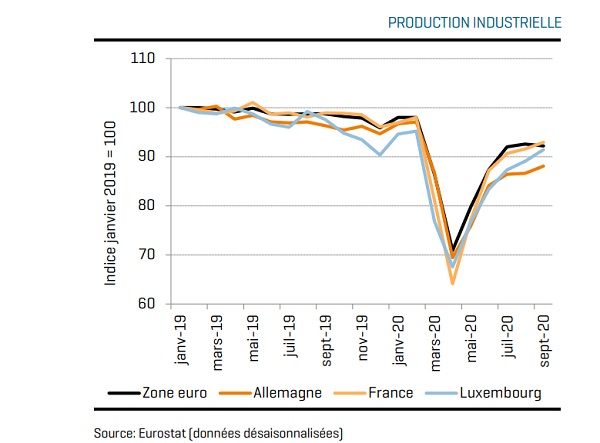

Over the first nine months of the year, Luxembourg's industrial production fell by 14% compared to the previous year, a little more than the average recorded in the euro area (down 11% over the same period). At the start of autumn, the level of Luxembourg production was relatively close to that of the end of 2019. Despite a slight drop in November, the confidence of Luxembourg industrialists seems to follow the trend of improvement which began in May.

Household consumption in Luxembourg is expected to have rebounded sharply in the third quarter of 2020, after dropping by 16% in the previous quarter. This decline was explained in particular by the forced closure of non-essential businesses during the spring lockdown. Retail sales volume hit a low in April (down 36% compared to January) but started to rise again with the reopening of shops. The rebound was particularly noticeable for trade in capital goods but even for these brands, the catching up has been insufficient and has left sales at the end of the first nine months 3-4% lower than the same period of the previous year. Fuel flows were the most impacted in the spring and the possibilities for catching up are very limited (down 8% over one year after nine months). In contrast, the sales volume of non-specialised stores, which remained open in the spring, increased by 8% this year.

Thanks to monetary and budgetary support measures, Luxembourg's banks were able to continue to grant low-rate loans to local companies over the first nine months of the year (up 7.2% over one year). However, with the resumption of health restrictions weighing on economic activity in the fourth quarter and the gradual end of the moratoria, the risk of default on loans is increasing. Faced with this gloomy economic outlook, euro area banks have started to tighten the criteria for granting new loans in the third quarter and plan to do the same in the fourth quarter. Luxembourg banks are especially cautious about long-term loan applications from businesses and households. In addition, banks in the Grand Duchy will have to apply new limits on mortgage loans from January 2021; the loan amount cannot indeed exceed 90% of the price of the property for a change of residence or 80% in the case of a rental investment.

Over the first nine months of 2020, premiums received by insurance companies fell by 34% for life insurance products but increased by 7.5% for non-life insurance over one year. The health crisis had a strong impact on life insurance. Non-life insurance was notably further boosted by relocations linked to Brexit ( a 10% increase in premiums linked to relocations over one year, compared to 4.3% for companies working mainly in Luxembourg). In August 2020, employment in insurance companies continued to grow (up 1.8% year-on-year), while it fell by 1.6% in banks.

Finally, STATEC estimated that the CO2 tax set to come into force in Luxembourg next January would induce a 6% reduction in greenhouse gas emissions in 2021, compared to a situation without such a tax - a relative rather than an absolute decrease. Given a relatively high price sensitivity, fuel sales are expected to fall by 8% and petrol and heating oil consumption to fall by 2% in 2021 compared to a tax-free situation. The introduction of the CO2 tax thus makes it possible to moderate the upward momentum in emissions expected with the rebound in activity in 2021: without a CO2 tax, greenhouse gas emissions would increase by 11% in 2021 compared to 2020, compared to only 4% with the CO2 tax. In the longer term, the CO2 tax alone would not be sufficient to reduce emissions sustainably, but would remain a necessary condition to achieve climate objectives.