On Friday 20 October 2020, Luxembourg's Minister of Finance, Pierre Gramegna, presented, to the joint meeting of the Finance and Budget Committee (Cofibu) and the Budget Execution Control Committee (Comexbu) the situation of public finances at the end of October 2020.

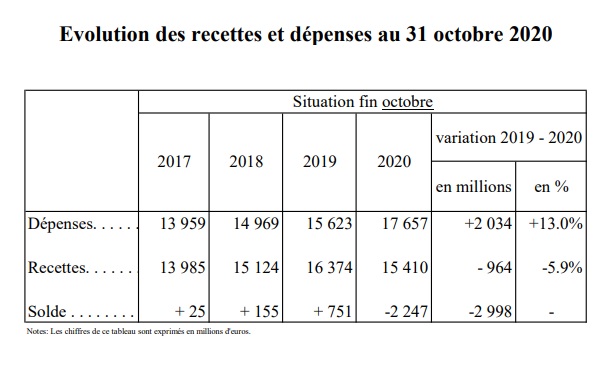

As of 31 October 2020, the central government balance stood at -€2.2 billion, which is equivalent to a decline of €3 billion compared to October 2019.

According to European SEC 2010 standards, revenues have fallen by 5.9%. This decrease can be explained, among other things, by the tax measures put in place to meet the liquidity needs of businesses during the COVID-19 pandemic. Cancellations of advances and payment deadlines represent capital losses for a total amount of €229 million as of 31 October. The acceleration of VAT refunds also widened the deficit.

Spending increased by 13% compared to October 2019. This substantial increase, already observed in recent months, continues to be the result of the measures put in place by the government to thwart the crisis duer to the COVID-19 pandemic. Taken together, direct and indirect investments have indeed increased by €352 million, or +19.5%, between the situation observed after the first ten months of 2020 and the same period of the fiscal year 2019. These investments are, among other things, attributable to crisis measures in favour of the High Commission for National Protection (HCPN) as well as to aid granted to companies.

Despite the unfavourable evolution of income and expenditure in annual comparison, we can however see from a monthly perspective that the central administration deficit improved by around €500 million between September 2020 and October 2020 and that the negative effect is gradually stabilising thanks to a weakening of the downward trend observed in revenue.

As for the figures established according to the rules of State accounting, the revenues reached on 31 October of this year represent 75.3% of the total budget voted for 2020, which corresponds to an execution rate of 8 percentage points lower than the theoretical rate which should have been reached at the end of October. Expenditures, meanwhile, reached an execution rate of 91.2%, or about 8 percentage points above the execution rate theoretically expected for the end of October.

Finance Minister Pierre Gramegna commented “The financial situation in October shows that the Grand Duchy continues to evolve in a difficult environment marked by the health crisis and its impact on the economy. The presentation of the figures as at 31 October is only a snapshot of the date in question and not a projection taking into account the factors which will still impact the balances until the end of the financial year, such as in particular the repayment to be made at Social Security following the Quadripartie. In the same sense, despite the stabilisation observed in tax revenue, which I welcome, the expenditure to be made in order to promote the recovery is likely to have a greater influence on the central government balance in the months that follow. In addition, the second wave of the pandemic that the country is currently facing heightens the uncertainties linked to the impact of the crisis on the Luxembourg economy. This additional challenge will undoubtedly have implications for budget execution. While the government’s priority is to fight the health crisis with the aim of ensuring, above all, the health of citizens and the economy, it is however also necessary to ensure the health of public finances in the short and medium term. It is with this in mind that the Ministry of Finance will continue to closely monitor budget execution."