Credit: STATEC

Credit: STATEC

STATEC, the national statistics institute, has published its findings on the financial health of companies in Luxembourg in the context of the COVID-19 pandemic.

In order to measure the economic impact of the COVID-19 crisis on businesses, STATEC has calculated indicators to assess the liquidity situation of the various branches of economic activity. The analysis was carried out using the most recent data available from the Central Balance Sheet Office. In normal times, companies aim to have a sufficient level of liquidity to ensure the proper functioning of their operations. The level of liquidity depends, among other things, on the type of activity carried out by the company and its cash management policy.

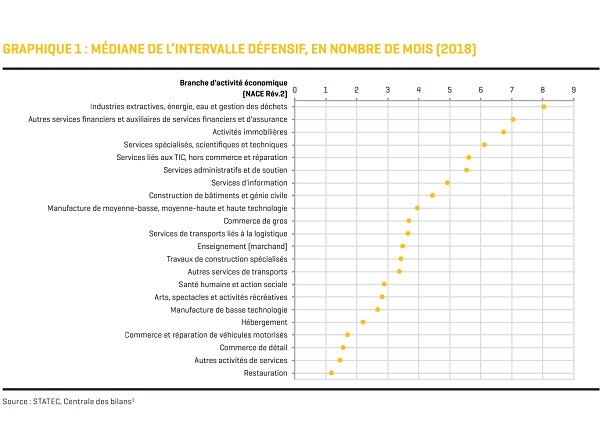

The defensive interval ratio (DIR: ratio between liquid assets and average daily operating expenses) is relevant for establishing the level of liquidity in an extreme context. It measures the period during which a company can continue to operate without touching fixed assets and without resorting to additional external financing resources. The higher the "defensive interval", the longer the time that companies can meet their operating expenses. In 2018, the median of the “defensive interval” ratio was between one and two months in catering, other service activities, retail trade, trade and repair of motor vehicles. The median was more than six months in the extractive, energy, water and waste management industries, other financial services, real estate activities as well as specialised, scientific and technical services. This indicator provides information on the financial vulnerability of companies.

The entry into force of the Central Balance Sheet Office in 2011, with the application of a national standardised accounting plan (PCN), marked a turning point in Luxembourg's accounting history. The Central Balance Sheet Office amplifies the financial information available to economic players (competitors, creditors and customers) and therefore promotes market transparency. The Central Balance Sheet Office also reduces the administrative burden on businesses and simplifies the work of the administration. STATEC uses financial data from the Central Balance Sheet Office as a complementary source to its surveys.