Balance of payments;

Credit: Statec; BCL

Balance of payments;

Credit: Statec; BCL

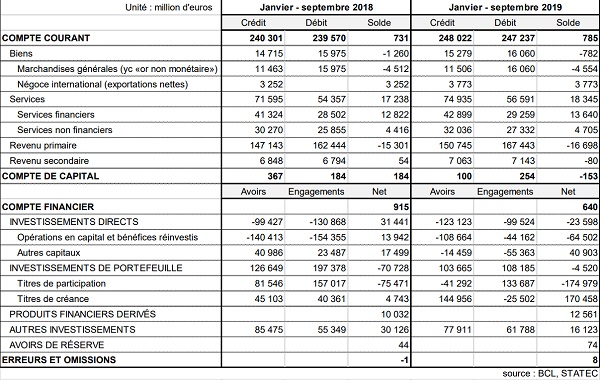

The Luxembourg economy recorded a surplus of €785 million in the first three quarters of 2019, according to the Banque centrale du Luxembourg (BCL) and STATEC.

STATEC and the BCL have reported that current accounts ended with a surplus of €785 million the first three quarters of 2019, up €54 million (+7.3%) compared to the same period in 2018.

More specifically, the trade deficit absorbed some €478 million as a result of the significant increase in net exports (€521 million) related to international trade. The "traditional" trade balance remained structurally in deficit and varied only slightly during the first nine months of 2019 (-€42 million euros). The balance of international trade in services for the first three quarters of 2019 amounted to €18.3 billion , an increase of more than €1.1 billion compared to the same period of 2018 (+6.4%).

Three-quarters of this growth came from financial services, whose exports and imports recorded growth rates of +3.8% and +2.7% respectively. This performance was linked to the favourable development of average net assets under management of investment funds over the same period (+3.6%). The surplus generated by non-financial services increased by around €290 million (+6.5%), particularly as a result of other business services.

In the financial account, direct investment flows remained characterised by disinvestment operations both for assets (-€123 billion euros) and for commitments (-€99 billion). Regarding portfolio investments, transactions in securities issued by Luxembourg (mainly UCI shares) resulted in a decrease in inflows (€134 billion) in the first three quarters of 2019 compared to the same period in 2018. In the case of foreign securities, residents abandoned equity securities (net sales of €41 billion) in favour of debt securities (net purchases of €145 billion).

Direct investment and portfolio flows thus resulted in net inflows of €28 billion in the first three quarters of 2019, entirely offset by net outflows in derivatives as well as in other investment flows (conventional deposits and credits).