Construction confidence indicator: Black - Luxembourg; Yellow - Eurozone;

Credit: STATEC

Construction confidence indicator: Black - Luxembourg; Yellow - Eurozone;

Credit: STATEC

Luxembourg's national statistics portal, STATEC, has reported that the drop in demand in the real estate market has had negative consequences on construction activity.

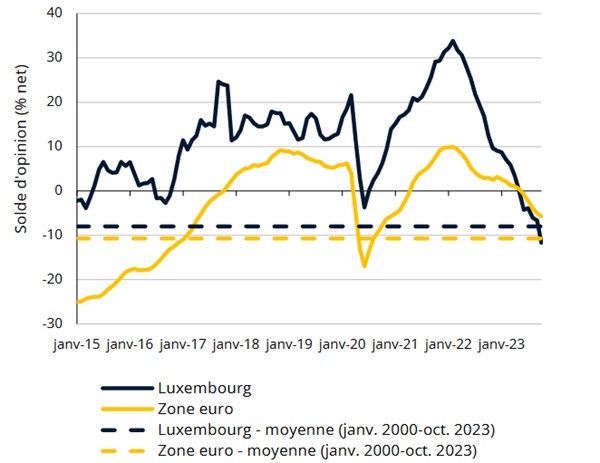

The economic indicators for the construction sector showed a clear deterioration, particularly regarding building construction. This downturn has significantly impacted the confidence of construction companies in recent months, with the confidence indicator reaching a new low since the COVID crisis, especially in Luxembourg compared to the eurozone.

The confidence indicator is based on entrepreneurs' perceptions of their order books and employment prospects. Both components have been on a downward trend since spring 2022, emphasising a substantial decline in the state of the order book. Luxembourg and Germany appeared to be the most affected among neighbouring countries, reflecting a decline in construction activity supported by various construction and real estate indicators, STATEC noted.

The gross value added (GVA) in construction volume in Luxembourg witnessed a 6% year-on-year decline in the first half of 2023, particularly affecting building construction with a nearly 12% drop in GVA. Salaried employment in the construction sector has been decreasing since spring 2023, with a notable fall of 2.7% year-on-year in October 2023, surpassing the decline observed during the 2009 financial crisis.

Luxembourg is one of the four countries in the eurozone (together with Italy, Lithuania and Estonia) where construction employment fell year-on-year in the second quarter of 2023 (according to the latest figures available). At the same time, the number of job seekers from construction registered with ADEM is increasing sharply (up 45% year-on-year in October 2023), while the stock of job offers is decreasing, reflecting lower demand for the workforce.

The decline in real estate transactions, triggered by rising interest rates, has resulted in a nearly 50% drop in transactions during the first half of 2023. Real estate prices have started to adjust, falling for the third consecutive quarter. New real estate loans are decreasing, indicating a persistently weak demand. Banks do not expect a turnaround at the end of the year, which suggests that construction difficulties will continue, at least for the remainder of 2023.

Despite these challenges, there are some positive signs, including a slight improvement in business confidence in October and November, particularly in sectors such as transport, accommodation, advertising, market services and study activities and, to a lesser extent, legal and accounting services. However, the overall employment outlook remains on a deteriorating trend, STATEC pointed out.

The rise in key interest rates has allowed banks to increase rates on savings accounts, resulting in increased savings by households. Luxembourg is therefore the country having most sharply increased household deposit rates in the eurozone.