Number of apartment sales and corresponding financial volumes (statistics from notarial deeds);

Credit: STATEC / Housing Observatory / AED

Number of apartment sales and corresponding financial volumes (statistics from notarial deeds);

Credit: STATEC / Housing Observatory / AED

On Thursday 26 June 2025, Luxembourg's Housing Observatory published its eighteenth analytical report, presenting an overview of developments in residential real estate activity, sale prices and advertised rents during the first quarter (Q1) of 2025.

The report highlighted a significant slowdown in real estate and land market activity in Q1 2025, as well as ongoing price stabilisation and moderate rent increases.

Detailed findings include:

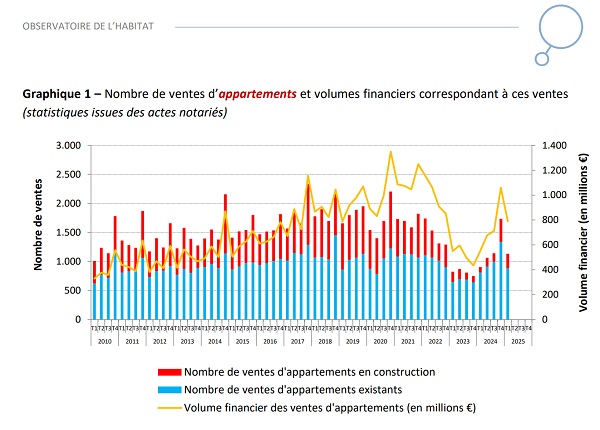

Number of housing sales

Activity in the real estate and land markets slowed significantly in Q1 2025, following strong growth at the end of 2024. Some transactions were completed early in Q4 2024 by buyers expecting the expiration of tax measures, particularly the halving of the taxable base for registration and transcription fees, accelerated depreciation to 6% and the taxation of disposal profits at a quarter of the overall rate. As these measures were ultimately extended until 30 June 2025, it is possible that a new surge in activity will be observed in Q2 2025.

The Housing Observatory noted that activity in the existing property segment was slightly higher than one year earlier: increases of 9.0% and 28.8% respectively for the number of transactions involving existing apartments and existing houses. However, activity in these two segments remained significantly below the average for the years preceding the crisis (e.g. 582 sales of existing homes in Q1 2025, compared to an average of 773 sales in the first quarter for 2017 to 2021).

In the off-plan apartment segment, the Housing Observatory observed a 163.5% increase in the number of transactions compared to Q1 2024, marking the lowest level of activity recorded in this segment since these statistics began in 2007. However, the number of transactions remained 2.5 times lower than the average for the years preceding the crisis (253 transactions compared to an average of 673 sales of apartments under construction in the first quarter for 2017 to 2021).

Real estate prices

The hedonic index of residential sales prices provided by STATEC (including existing and under-construction properties) confirmed the ongoing price stabilisation since the beginning of 2024: the aggregate index even dropped by 1.2% compared to Q4 2024 but increased by 0.9% over twelve months.

In the existing apartment segment, the hedonic index was down by 0.8% over one quarter but up by 1.2% over one year. Since the beginning of 2024, there has been considerable quarterly variability in this series of existing apartment prices, but the trend is stable.

The same observation can be made for the existing homes segment: the hedonic index fell by 1.2% compared to Q4 2024 but remained up over twelve months (+0.9% compared to Q1 2024), also with marked quarterly variations.

In the off-plan apartments segment, price volatility was even more pronounced. Prices dropped by 2.1% over one quarter but remained stable over twelve months (-0.1%). Trends in this segment remain highly volatile, as the number of transactions is very limited and the market is therefore subject to strong composition effects, according to the Housing Observatory.

Advertised rents

Advertised apartment rents decreased by 0.8% compared to Q4 2024 but increased by 1.5% compared to Q1 2024. At the same time, consumer price inflation returned to levels in line with the long-term average: up 1.6% over one year. The current lease rental index followed a similar trend (+1.7%). Consumer price inflation has slowed significantly in recent months, after remaining above +3% over twelve months for a prolonged period.

In the rather specific segment of furnished room rentals, which currently represents approximately 18% of the total rental supply, the increase in advertised rents reached 2.2% compared to Q1 2024.

The Housing Observatory noted that these figures reflect asking rents for new rental contracts. The increase in rents during the lease (for tenants who do not change accommodation) is also relatively moderate. According to STATEC statistics, the rent index will have increased by 1.7% between Q1 2024 and Q1 2025, which is very similar to the inflation in consumer prices measured by the national consumer price index (+1.6% over the same period).

The report is based on data collected by STATEC and the Housing Observatory, in collaboration with the Registration Duties, Estates and VAT Authority (AED), on housing activity and sales prices (from notarial deeds). It also used data provided by the real estate portal Immotop.lu on advertised housing rents (from real estate listings).