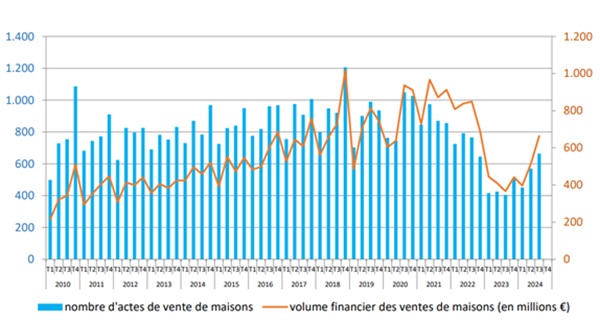

Number of house sales and financial volumes corresponding to these sales (statistics from notarial deeds);

Credit: STATEC

Number of house sales and financial volumes corresponding to these sales (statistics from notarial deeds);

Credit: STATEC

Luxembourg's Housing Observatory has recently published its latest report, offering insights into the residential real estate market for the third quarter of 2024.

The analysis, communicated by Luxembourg’s Ministry of Housing and Spatial Planning, highlights growth in market activity, stabilisation in sales prices and a continued rise in advertised rents.

Activity in the market for existing properties, which includes already-built apartments and houses, showed significant growth during the third quarter. The number of sales for existing apartments increased by 44.2% compared to the same period in 2023, while sales of existing houses rose by 64.0% year-on-year. This recovery signals a rebound after a challenging 2023, marked by a low number of transactions. However, the market for apartments under construction remains subdued, with only 144 transactions recorded during the quarter. This figure is nearly four times lower than the average for the years prior to 2023, when quarterly transactions in this segment often exceeded 570.

The report also confirms a stabilisation in sales prices (provided by STATEC). The aggregate hedonic price index for housing, which includes both existing and under-construction properties, was stable compared to the previous quarter, rising slightly by 0.2%. Over twelve months, the index showed a modest decline of 1.7%. For existing apartments, prices remained steady, decreasing by only 0.1% compared to the previous quarter, though they were still 3.6% lower than in the third quarter of 2023. The report attributes this year-on-year decline primarily to trends observed in late 2023. In the market for existing houses, prices rose by 2.0% during the quarter, reflecting stability over the past year with a slight annual increase of 0.3%. In contrast, prices for apartments under construction dropped by 2.5% during the quarter and by 2.6% over twelve months. These fluctuations remain volatile due to the limited number of transactions in this segment, the report noted.

Advertised rents for apartments saw a slight quarterly decrease of 1.6%, yet they remain 3.6% higher compared to the same period in 2023. This annual increase significantly outpaces consumer price inflation, which was measured at 1.6% over the same timeframe. Within the niche segment of furnished room rentals, which currently account for around 17% of the total rental supply, advertised rents increased even more sharply, rising by 4.5% year-on-year. Note that these figures represent the rents requested by landlords for new contracts, whereas rent increases for ongoing leases remain more moderate, aligning closely with inflation rates.