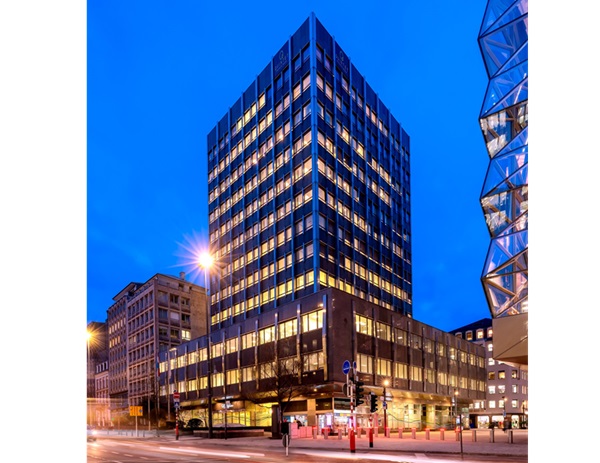

Credit: Quintet Private Bank

Credit: Quintet Private Bank

Luxembourg-headquartered Quintet Private Bank has announced its positive financial results for 2023, including a full-year net profit of €46.9 million, up from €18.1 million in 2022.

Quintet Private Bank was founded 75 years ago in Luxembourg and it operates across Europe and the UK.

Total group income rose to to €602.4 million in 2023, up 15% compared to €524 million in 2022. Group expenses remained largely stable at €522.1 million in 2023, compared to €493.2 million the previous year. Consequently, despite significant market volatility and sustained inflationary pressure, Quintet’s 2023 cost-to-income ratio stood at 86.7%, compared to 94.1% in 2022.

As of 31 December 2023, total client assets stood at €92 billion, up 6% from €86.7 billion at the end of 2022. This reflects increases in both private banking assets under management and institutional assets under custody, Quintet reported.

Quintet’s Basel III common equity tier 1 ratio stood at 19.6% at the end of 2023, up from 18.4% at the end of the previous year and above the regulatory threshold. The firm’s liquidity coverage ratio stood at 147.9% at the end of 2023, compared to 153.2% at the end of 2022 and also above the regulatory threshold. Quintet added that current sources of funding and liquidity remained “extremely stable”.

“We are pleased with Quintet’s performance last year and, just as important, the material progress achieved in advancing our long-term growth agenda,” said Rory Tapner, Chair of the Board of Directors. “As we continue our journey as a private bank with a unique heritage and footprint, we are grateful to our colleagues for their commitment, collaborative spirit and client focus.”

“Today more than ever,” Tapner added, “our business is differentiated by deep personal relationships and holistic advice, founded upon open-architecture principles.”

“2023 was another positive year for Quintet,” said Group CEO Chris Allen. “Overall financial performance was robust over a twelve-month period when we strengthened the foundation of our firm to support sustained growth, including by increasing organisational agility and collaboration in service to our clients. We also extended our investment capabilities last year through a refreshed philosophy and partnerships with firms such as BlackRock and Moonfare, further enhancing our client proposition.”