Credit: ILR

Credit: ILR

On Tuesday 21 June 2022, the Statistics and Market Watch department of the Luxembourg Institute of Regulation (Institut Luxembourgeois de Régulation - ILR) published its telecommunications statistical report for the year 2021 and the studies of mobile service tariffs and fixed internet access service tariffs in Luxembourg for 2022.

The telecommunications statistical report highlighted key figures of the telecommunications market in 2021, illustrating changes in volumes, revenues and technical data according to data collected from different operators.

After two consecutive years of declines in mobile service revenue, a consequence of the COVID-19 pandemic, operators witnessed growth of 7.0% in 2021 compared to 2020. The number of fixed internet accesses sold for download speed greater than or equal to 100 Mbps has grown by 13.8% in 2021.

Increase in sales of ultra-high-speed fixed internet subscriptions

Fixed internet is up 3.5% compared to 2020, with the fast-growing share of fixed internet access posting a download speed greater than or equal to 100 Mbps now representing 72.3% of connections. Fibre optics, which has exceeded other technologies since 2020 (xDSL and CATV cable), represents 134,600 accesses at the end of 2021 (up 13.9% in one year). Fibre optics is thus activated for 56.2% of the total number of 239,500 fixed internet accesses. Over the past five years, the rapid activation of fibre optics has thus increased by an average of 17.7% on an annual basis.

Stability of average revenues of fixed internet operators

The average revenue per connection for the fixed telephony service droped to €17.60 in 2021 (down 17.5% on an annual basis, excluding taxes). This amount comes largely from business subscriptions with an average monthly income of €53.70 per connection. Operators realised on average by fixed internet access a stable income of €50.40, independently of the strong migration to fibre optics. Mobile services contribute on average with €23.50 per month per active SIM card, up 3.9%.

Excellent coverage of Luxembourg by very high capacity network

Luxembourg's very high-capacity network coverage remains excellent with more than 95% of housing and premises. This availability is ensured mainly by the CATV cable network (mainly operated by the company Eltrona) and the fibre optic network of Post Luxembourg.

Fall in the dynamics of the fixed and mobile services market

The dynamics of the fixed and mobile services market fell significantly in 2021. This finding is based on the sharp drop in the number of phone number ports for customers changing fixed or mobile operator while keeping their phone number. It should be noted that number portability allows any user to keep their telephone number in the event of a change of electronic communications operator.

Among POST Luxembourg's regulated wholesale activities, unbundled fibre optic access offered to alternative operators has increased rapidly in 2021 and reached 32,000 fibre optic accesses (up 39.2% on an annual basis). This volume almost doubled between 2019 and 2021.

Tariffs for mobile services in Luxembourg in 2022

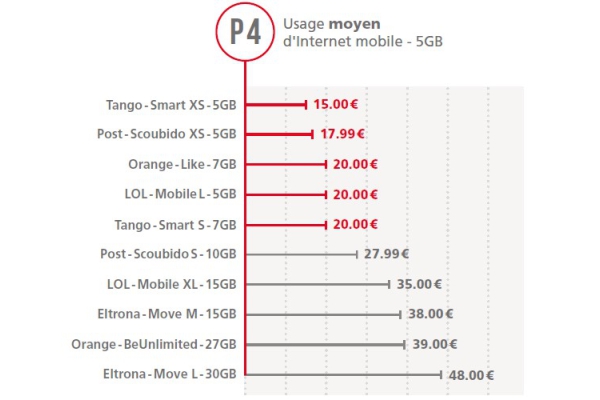

The purpose of the study of mobile service tariffs is to present in a synthetic and transparent manner the costs of the mobile service offers (voice, SMS and mobile Internet) marketed at the start of 2022 on the Luxembourg market for six consumption profiles, including the level of Mobile internet usage varying from low (P1: 0 GB) to intensive (P6: 20 GB). The study focuses on the offers of the five providers active in the mobile services market.

The results of the study are established according to the methodology defined by the ILR, which consists of determining the monthly costs of each offer consulted for the defined consumption profiles, then selecting the two cheapest offers from each service provider for each profile.

The monthly cost of the cheapest offers is between €10.00 for the moderate mobile internet consumption profiles (P2: 1.25 GB and P3: 2.5 GB) and €37.99 for the intensive consumption profile (P6: 20 GB). The average (P4: 5 GB) and high (P5: 10 GB) consumption profiles recorded a cost of €15.00 and €27.99 for the cheapest offer.

Compared to 2021, the monthly cost of the cheapest offer decreased by 25.0% for P4, 6.7% for P5 and 2.6% for P6. For the P2 and P3 profiles, the cost remains stable.

Tariffs for fixed internet access services in Luxembourg - 2022

The purpose of the study of fixed internet access service prices is to provide a summary and transparent presentation of the costs of fixed Internet access service offers for each of the types of service defined. The service typology is based on the association between the combination of services and the downward speed declared by the service providers. The following combinations have been defined with, for each of them, three speed levels (V2: less or equal to 100 Mbps, V3: 100 Mbps and 1,000 Mbps, V4: over 1,000 Mbps):

- Single Play (1P - Fixed Internet)

- Dual Play (2P - Fixed Internet + Fixed Telephony)

- Triple Play (3P - Fixed Internet + Fixed Telephony + Television) and,

- Quadruple Play (4P, 3P plus mobile services).

The study focuses on the offers of nine providers with local, regional or national coverage and offering xDSL, cable (CATV) and fibre optic technologies.

The results of the study are established according to the methodology defined by the ILR which consists in determining the monthly costs of the offers marketed on the market and presenting them in the graphs established by type of service.

The calculation of the monthly cost of the cheapest offer shows an unequal evolution according to the type of service and according to the downward speed between 2021 and 2022. For the combinations of 1P and 2P services, the reduction in the cost of the least expensive offer is significantly expensive for V2 and V4 speeds. For the 3P combination, the cost decreaseed for V3 speeds but noted higher for V4. The monthly costs of the cheapest offers of the 4P combination increased markedly for V2 and V3 speeds and marginally for V4 speed.