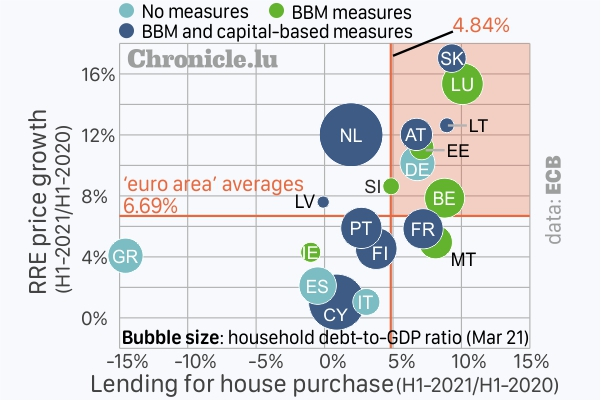

RRE price growth and household indebtedness in the euro area;

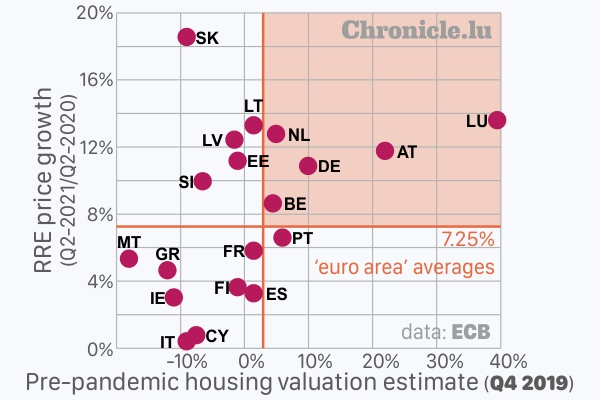

RRE price growth and household indebtedness in the euro area;

According to the Financial Stability Review of November 2021 published by the European Central Bank (ECB), housing prices in the euro area in the second quarter of 2021 (Q2-2021) rose at the fastest pace since 2005; Luxembourg recorded the second highest price increase.

While the economic recovery is supported by the near-term fundamentals of the housing market, the ECB noted in its report that the residential real estate (RRE) price growth of around 6.7% (first half of 2021 compared to first half of 2020; H1-2021/H1-2020) at the euro area aggregate level remains a cause for concern amid signs of more broad-based price increases across both urban and non-urban areas. The bubble size indicates the household debt-to-GDP ratio as of March 2021.

Seven member states recorded double digit growth with Slovakia at the highest rate of 17.05% followed by Luxembourg at 15.35%.

Generally, the high and rising levels of household indebtedness contribute to heightened medium-term vulnerabilities and the ECB recommended activation of macroprudential policy measures, where necessary. Some countries have started borrower-based (BBM) macroprudential measures such as collateral or income-based limits (green) and others have applied both capital-based (e.g. risk weights on RRE exposures) and borrower-based macroprudential measures (dark blue).

In some countries, the growth in RRE markets is coupled with high mortgage lending (x-axis) and there is evidence of a progressive deterioration in lending standards, as reflected by the increasing share of loans with high loan-to-value and loan-to-income ratios (data not shown here), indicating signs of easing in mortgage lending standards.

House prices have generally risen more in countries which had stretched valuations prior to the pandemic (countries on the right side of the chart), which further increased the estimated overvaluation. Some of these rises could be partly due to increase in demand during the pandemic, but growing signs of overvaluation as a whole render markets more prone to a correction, especially countries with more elevated valuation levels (orange highlighted area).

The risks of a price correction and the build-up of vulnerabilities had already led the European Systemic Risk Board (ESRB) to issue warnings (France and Germany) or recommendations (Belgium, Luxembourg, Netherlands and Finland), as early as September 2019.