Credit: CSSF

Credit: CSSF

The Commission de Surveillance du Secteur Financier (CSSF) recently published its report on the profit and loss accounts of credit institutions as at 31 March 2025.

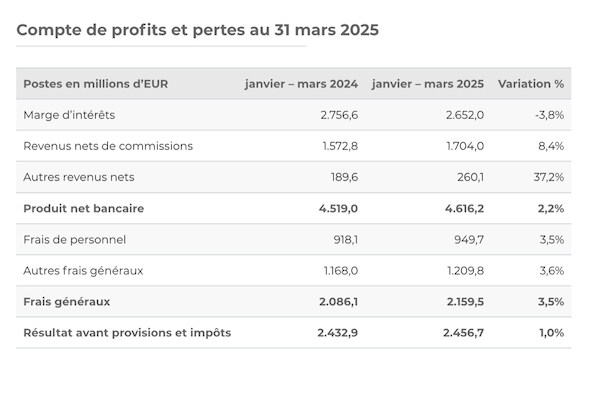

According to the CSSF, the result before provisions and taxes for Luxembourg’s banking sector reached €2,456.7 million in the first quarter of 2025, marking a 1.0% increase compared to the same period in 2024.

However, the CSSF noted that net interest income declined by 3.8% year-on-year in the first quarter of 2025. This decrease, observed in 55% of banks, was linked to the downward trend in interest rates that began in the second half of 2024, putting pressure on interest-related revenues across the sector.

The report described an 8.4% year-on-year increase in net commission income in the first quarter of 2025. This growth concerned 66% of banks, particularly those offering wealth management services to private and institutional clients, including investment funds. For these institutions, the average value of assets under custody, the basis for calculating custody fees, rose by 8.8% compared to the same period last year.

The CSSF report also noted that other net income – comprising various elements that are typically volatile and non-recurring – rose by 37.2% year-on-year.

General expenses increased by 3.5%, attributed to a 3.5% rise in staff costs and a 3.6% increase in other operational expenses.

These developments brought the cost-to-income ratio to 46.7%, slightly up from 46.2% in the first quarter of 2024. As of 31 March 2025, 14 out of the 116 banks operating in Luxembourg reported a negative result.