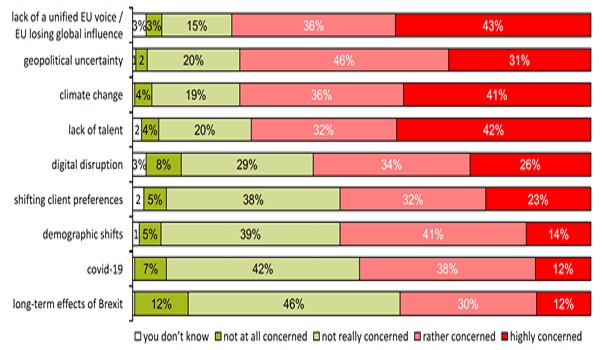

Socio-economic factors of concern;

Credit: Luxembourg for Finance Financial Services Survey, October 2021

Socio-economic factors of concern;

Credit: Luxembourg for Finance Financial Services Survey, October 2021

On the other hand, firms in Luxembourg have taken to heart the need to protect vulnerable systems and client data, with 79% confident in their organisations' ability to handle the cybersecurity challenge. Moreover, the shift to home-based work has been smooth, with 88% of respondents confident in their organisations' ability to deal with any possible challenges that might arise in the coming twelve months.

The survey revealed that, in general, Luxembourg’s financial services industry seems to be well-prepared to handle the challenges relating to sustainable finance: 71% of respondents wre confident in their organisations' ability to include environmental, social and governance (ESG) considerations into client advice, 64% in identifying sustainable investment opportunities and 68% in designing sustainable products. However, the availability of quality sustainable data and the fragmentation of standards remain major concerns for respondents, in line with the global trend.

Commenting on the survey results, Nicolas Mackel, CEO of Luxembourg for Finance, said: “Given increasing macro-economic challenges and nationalistic voices against the single market it is critical that financial services across the EU work well to finance the recovery sustainably and effectively. Thus, the surge in optimism relating to the overall financial services climate is encouraging as finance will have a large role to play in rebuilding the global economy”.