The latest Europe-wide ING International Survey offers interesting insights on what determines our attitudes towards saving and investing: while in Luxembourg outside factors like the COVID-19 crisis seem to have had little effect on respondents’ behaviour towards savings, one inherent factor makes a great difference in how we save: our gender.

Among the 516 Luxembourg residents who took part in the survey, 53% were Luxembourgers, with a further 37% made of French, Portuguese, Belgian and Italian respondents. According to ING, the survey is representative in terms of nationality. This survey has been deployed by IPSOS across Europe, and TNS Ilres in Luxembourg.

Did the pandemic lead to a decrease in savings?

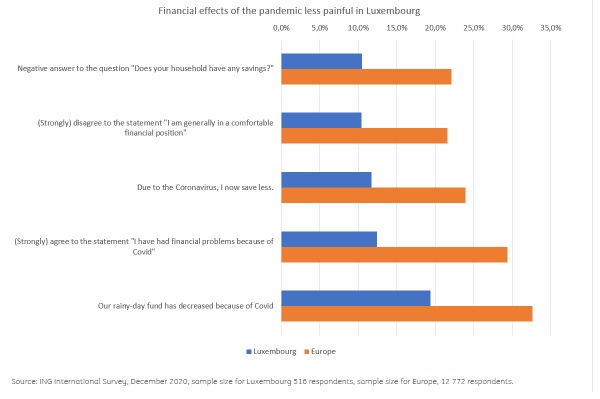

Interestingly, in Luxembourg the pandemic only led to a declared decrease in savings for a minority of people. On average, the pandemic did not affect people’s savings. As illustrated below, respondents residing in Luxembourg have been relatively unaffected by COVID-19 financially compared to the rest of Europe. Still, 12% have been saving less due to the COVID-crisis, while 32% have been saving more than before the pandemic. Among the latter, 73% reported doing so because they didn't have the opportunity to spend due to closed stores, cancelled events, etc.

Why save anyway?

60% of Luxembourg respondents living in a household with no savings (54 respondents) feel uncomfortable with their level of savings. This percentage drops to 10% when the household has at least some savings. This huge gap suggests that the liquidity provided by the first layer of savings, such as rainy-day funds and savings accounts, is the most effective in reducing financial stress. For many who live on the edge financially, setting up an automatic monthly transfer for even a modest amount towards a savings account may be the best way to reduce stress.

What determines our attitude to saving?

Neither age, nor education, working status, or region make any significant direct difference in how we save and invest, except in the obvious sense that they affect how much we can save – our saving capacity. Likewise, nationality – Luxembourgish or not – plays almost no role in our attitude to saving and investing[1]. Respondents whose nationality is Luxembourgish are only a bit more likely to favour investing in real estate (72%) than foreigners (66%).

The crucial role of gender

The one single factor that does seem to make a significant difference in how we save and invest, on the other hand, is gender. It starts with self-confidence. One in three men, but only one in seven women, rate their own financial knowledge at 8 or better on a scale of 0 to 10 (0 being not confident at all, and 10 fully confident).

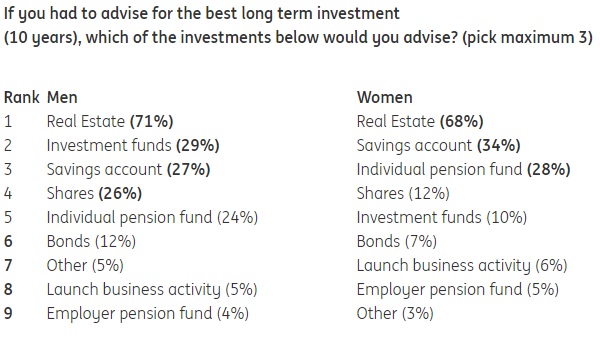

It goes on with investment preferences. When asked what they would advise as the best long term investment (10 years), women name fewer options as men (1.7 vs. 2 on average). Real estate stands out as the clear favourite for both genders, being named by 69% of respondents. Individual pension funds are also equally popular, with about a quarter of respondents on both sides. But that’s where the similitudes end: Luxembourg men are much more likely to recommend investing in higher-yielding assets like shares and investment funds (29% of men would recommend investing in funds, but only 10% of women make the same recommendation), while women are more drawn towards investments usually considered safe and with little upside, such as savings accounts.

Does this mean that women are inherently more conservative investors than men? Not necessarily. Other factors may be at play, such as investing capacity. For every woman who works part-time, 2 women work full-time. According to the employment status declared in the survey, for every man who works part-time, 62 men work full time. A woman is 19 times more likely than a man to work part-time, which means she will earn a reduced salary compared to her male counterpart and has, as a result, less money to invest.

And it starts early! When asked whether they were given pocket money in childhood, more men than women reported being given pocket money on a regular basis (48% versus 40%) or for doing chores at home (19% versus 12%) or even for doing a job outside the home (23% versus 16%). And 20% of female respondents did not receive any pocket money in childhood at all, versus only 11% of men

What does that tell us?

The main conclusions of this survey is that the first layer of savings is the most important, and that less than one in five Luxembourg residents has experienced a negative financial impact from the pandemic while a majority has fared better than before so far, at least financially. The main lesson, though, is about gender: women residing in Luxembourg today seem to have grown up with less affinity to money than their male counterparts from an early age. Additionally, it would appear that they were given less opportunities to practice in dealing with money and that over the course of their careers, they globally earn significantly less than men as they experience fewer years of full time employment. All these factors may explain why women are able to put less money aside, why they are less confident in their ability to invest money, and why they are reluctant to invest in growth assets, all of which combines to explain why their net worth grows far more slowly than men’s in the long run.

These findings suggest that widely recommended measures such as sharing parental leave, avoiding salary discrimination, not penalising maternity leave etc., while important in their own right, may not be sufficient to reduce the financial gender gap because they start relatively late in women’s lives, after their “financial mind set” is more or less fully formed. To really break the loop, investing in childhood and adolescent financial education, especially for girls, and ensuring an equal opportunity early on to develop an affinity with paid work and money are promising avenues, as necessary as they are overlooked.