Credit: MFIN

Credit: MFIN

On Friday 26 November 2021, during a joint meeting of the finance and budget committee and the budget execution control committee of the Chamber of Deputies (Parliament), Luxembourg's Minister of Finance, Pierre Gramegna, provided an update on the State's financial situation as of 31 October 2021.

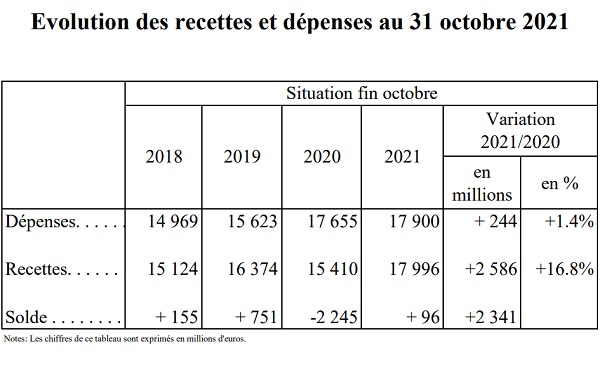

By the end of October 2021, total revenues stood at €18 billion, which represents an increase of €2.6 billion or 16.8% compared to the first ten months of 2020. State revenue stood at 94.4% of the voted budget, which is significantly higher than the 83.3% that should have been achieved over this period. Compared to October 2019, the increase is €1.6 billion, which is equivalent to an annual growth rate of 5% (or 10% over two years.

The Finance Minister commented: “I am pleased to note that the normalisation of economic life in Luxembourg goes hand in hand with a gradual improvement in the country's public finances. The State accounts are again slightly in surplus as of 31 October 2021 and they inspire confidence, since revenues are returning to the growth rate that we knew before the crisis and expenditure is back on the path to a more sustainable development thanks to responsible fiscal policy. As the end of the year approaches and two weeks before the parliamentary debates on the draft budget for 2022, I am delighted that public finances are thus continuing on a promising trajectory, which will make it possible to meet the challenges of tomorrow with serenity”.

This positive trend in revenue has been attributed to the very strong increase in VAT revenue collected, which rose by €688 million over one year. Even before the new wage indexation had an impact on salaries and pensions, revenue from witholding tax increased by €279 million due to the good performance of the labour market, according to the Ministry of Finance. In this regard, the unemployment rate continues to decline to return to pre-pandemic levels. Revenues collected through the subscription tax on investment funds increased by €240 million, while capital income tax revenues witnessed a strong increase of around €304 million over one year.

As for the excise duties levied on fuels (including the CO2 tax), revenue increased by €105 million compared to 2020. According to the Finance Minister, however, an analysis of these figures compared to those recorded in 2019 is better suited to identify the real impact of the government's environmental measures, since this was a year undisturbed by greatly reduced mobility due to the COVID-19 pandemic. In this regard, there has been a loss of revenue of €68 million compared to 31 October 2019, despite the introduction of the CO2 tax. A structural decline in fuel sales can be observed, both for petrol (down 12.3% in terms of litres sold compared to 2019) and for diesel (down 22.5%). At the same time, this corresponds to a reduction of around 21% in CO2 emissions from the sale of fuels, thereby contributing to the fulfillment of Luxembourg's commitments to the fight against climate change.

Public expenditure stood at €17.9 billion as of 31 October 2021, which represents an annual increase of €244 million or 1.4%. Compared to the same period in 2019, spending increased by €2.3 billion euros, which is equivalent to an average annual growth of around 7% (or 14% over two years). The fact that this rate remains high compared to the historical trend of around 5% has been attributed to the maintenance of certain measures to support the economy and the payments made under the various COVID-19 financial aid schemes. Related expenditure for the 2021 fiscal year amounted to around €608 million as of 31 October, bringing the total aid disbursed by the state to almost €2.7 billion since the outbreak of the pandemic in March 2020. There have been provisional expenses of around €6 million following the July floods, as well.

Beyond the aid schemes, the government will continue to support economic recovery through its public investment policy for which a total sum of €2.2 billion was spent over the first ten months of 2021. This represents an increase of 10% compared to 2020 (excluding an exceptional accounting effect that occurred in 2020 due to the accounting rules of the ESA 2010), or even an increase of 21% compared to the same period in 2019.

Moreover, social benefits have automatically decreased compared to 2020. This decrease amounts to €333 million or 15.5% and is mainly explained by the dissipation of expenditure under the short-time work scheme, which is being used increasingly less in view of the normalisation of economic life. On the other hand, intermediate consumption expenditure, which corresponds to operating costs, experienced an increase of €125 million or 9.7%, of which around half (i.e. €60 million) is attributable to expenditure in the COVID-19 vaccination campaign.

In conclusion, the positive jaws effect (which results from the fact that revenues increase more significantly than expenditure) means that the central government balance has significantly improved compared to 2020. As of 31 October 2021, the government recorded a a slightly surplus balance of €96 million, an improvement of €2.341 million compared to 31 October 2020. However, this balance remains below that observed in 2019, when the government posted a surplus of €751 million during this same period.

Minister Gramegna drew the following interim assessment: “Even if this is only a momentary picture of the situation, the figures as of 31 October 2021 are reassuring, since the positive trend of recent months has largely been confirmed. Given that uncertainties have increased in recent times, especially with regard to the evolution of the pandemic and inflationary pressures across the world, good control of public spending must continue to be ensured, while closely monitoring the evolution of revenue".