Credit: STATEC

Credit: STATEC

On Monday 9 February 2026, Luxembourg’s statistics institute, STATEC, published its updated inflation forecast along with an update on the national consumer price index.

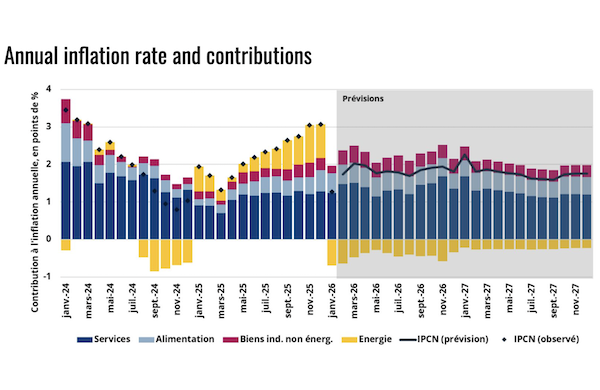

STATEC reported that falling energy prices at the beginning of 2026 have significantly slowed inflation compared with the final quarter of 2025. While favourable base effects linked to energy products had sharply driven up inflation towards the end of last year, the simultaneous decline in electricity and petroleum product prices helped reduce annual inflation to 1.3% in January 2026.

Energy prices are expected to continue exerting downward pressure on inflation over the coming years. Government support measures are projected to lower household electricity tariffs by around 10% in 2026 and a further 7% in 2027, while declining oil and gas prices on international markets are expected to keep petroleum product inflation subdued through to the end of 2027.

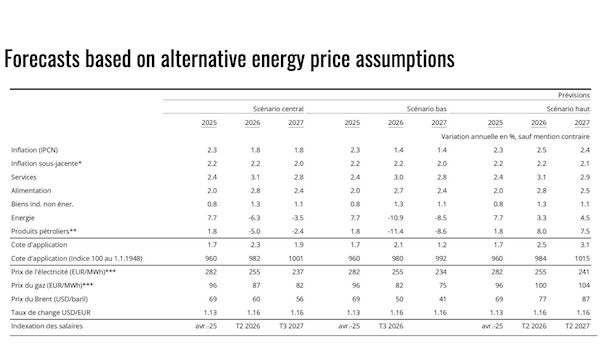

Crude oil prices are forecast to fall by 14% in 2026, to around $60 per barrel, followed by a further decline of 6% in 2027, amid global oversupply. In addition, the appreciation of the euro against the US dollar is expected to ease Europe’s oil bill. Falling gas prices on futures markets are also forecast to feed through to Luxembourg’s tariffs, with gas prices projected to decline by 10% in 2026 and 5% in 2027. Overall, energy prices in the Grand Duchy are expected to fall by 6.3% in 2026 and 3.5% in 2027.

Based on January 2026 projections from Oxford Economics, which underpin STATEC’s forecast, several upward pressures have been incorporated, leading to a revision of the euro area inflation outlook for 2026 from 1.5% to 1.7%. In this context, underlying inflation in Luxembourg is expected to remain elevated in 2026, at 2.2%, driven primarily by rising food prices and persistent service-sector inflation.

Food inflation is projected at 2.8% in 2026, easing to 2.4% in 2027, with unfavourable weather conditions and structural supply-side factors cited as key risks. Service inflation is forecast at 3.1% in 2026 before moderating to 2.8% the following year.

Overall, headline inflation in Luxembourg is forecast at 1.8% for both 2026 and 2027. Under this central scenario, the next wage indexation adjustment would take place in the second quarter of 2026, followed by another adjustment in the third quarter of 2027.

In the high-price scenario for Brent crude, STATEC noted upward risks linked to renewed geopolitical tensions, potential supply disruptions and stronger-than-expected global demand. Under this scenario, Brent prices would rise by 11% in 2026 and by a further 13% in 2027. Conversely, the low-price scenario assumes a persistently oversupplied global market, continued growth in non-OPEC production and weaker demand in a sluggish global macroeconomic environment, compounded by the long-term effects of the energy transition. In this case, Brent prices would fall sharply by 27% in 2026 and by 19% in 2027.

Recent developments also highlight significant asymmetries in gas price risks. Upward pressure could stem from Europe’s low storage levels, reported to be at their lowest seasonal point in several years, combined with tighter supply balances following faster-than-usual winter withdrawals. Additional risks could arise from exceptionally cold weather or new supply disruptions, including potential interruptions to US liquefied natural gas (LNG) production. Europe’s continued reliance on US LNG, which accounted for around 27% of imports in 2025, increases vulnerability to fluctuations in export volumes. In the high scenario, gas prices would rise by 4% in both 2026 and 2027, compared with declines of 10% and 5% respectively in the central scenario. In the low scenario, gas prices would fall by 14% in 2026 and by 10% in 2027.

Alternative inflation scenarios were also outlined, based on historical fluctuations in electricity, gas and Brent crude oil prices. In the high-inflation scenario, inflation would reach 2.5% in 2026 and 2.4% in 2027, resulting in two indexation adjustments: one in the second quarter of 2026 and another one year later. In the low-inflation scenario, with inflation at 1.4% in both years, only one indexation adjustment would occur, in the third quarter of 2026.