Mortgage loans;

Credit: BCE

Mortgage loans;

Credit: BCE

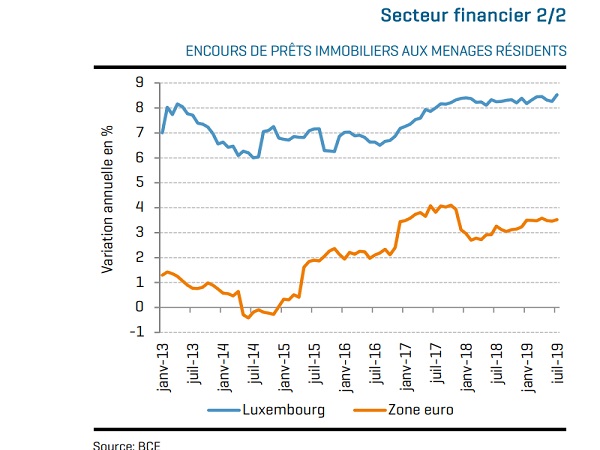

A recent economic report by Luxembourg's statistical agency, Statec, has revealed that, as of July 2019, mortgage loans increased 8.5% over one year.

The "Conjoncture Flash" report for September 2019 took into account the economic situation in Luxembourg, as well as that of the other countries in the eurozone. Indeed, whilst the morale of financial companies in these countries had recovered in early 2019, signs of concern reemerged in the third quarter of 2019.

Whilst insurance companies remained fairly confident about the evolution of their operating income, the report found this not to be the case for banks and financial auxiliaries (mainly related to investment funds in Luxembourg). While low interest rates effectively limited their revenues on risk-free assets, the stock market turmoil caused by the China-US trade war and Brexit uncertainties have affected the profitability of other assets.

The report similarly highlighted the continued expansion of mortgage lending. Since the beginning of 2015 and the decision of the European Central Bank (ECB) to reduce policy rates to 0%, real estate loans have become increasingly attractive with average interest rates continuously declining (from 2.1% in early 2015 to 1.8% in mid-2019 in Luxembourg, and from 2.4% to 1.6% on average in the eurozone). Indeed, in July 2019, mortgage loans increased by 8.5% over one year in Luxembourg and also increased in fourteen other euro area countries (+3.5% overall).

Statec has argued that this phenomenon raises issues in terms of the sustainability and impact on household debt and property prices, which have risen 18% since 2015 in the eurozone (compared to +10% between 2005 and 2014). In Luxembourg, real estate prices continue their upward trend, which began in 2010 at a sustained average rate of 5% per year (+28% between 2015 and early 2019). Household debt is also on the rise, accounting for 171% of disposable income at the end of 2017 (up 12% since the end of 2014).

Moreover, core inflation increased significantly in the Grand Duchy in the past quarters before stabilising at a level close to 2% over one year. That being said, the weakness of core inflation in the eurozone is more prolonged: for over two years, the average rate has remained close to 1.2% - although this rate hides very different inflationary pressures across countries and is largely influenced by inertia in a few large countries. In addition to Luxembourg, the strengthening of core inflation (in the first eight months of 2019) compared to 2018 was most significant in the Netherlands, Latvia, Ireland, Cyprus and Slovenia.

The Statec report also highlighted how the unemployment rate had bounced back in Luxembourg at the beginning of the year, a phenomenon that was primarily related to the introduction of social inclusion income; the rate rose from 5.1% of the active population in December 2018 to 5.%% in June, before falling again to 5.4% in July and August 2019.

Similarly, the report analysed the slow-down in industrial employment in Luxembourg, from +1.6% over one year in Q2 2018 to only +0.5% in Q1 2019. This has been attributed mainly to the food industry, which accounted for 12% of manufacturing industry employment in Luxembourg (as much as metallurgy).

Finally, the confidence of construction contractors in the euro area has also decreased moderately since the end of 2018. In Luxembourg too, one can perceive an almost identical evolution (even if the monthly results are much more volatile). In both cases, however, the morale of companies in the sector remains at historically high levels and production continues to grow; in the eurozone, this increased by almost 3% and in Luxembourg by 0.6% over one year in the first half of 2019.