The draft law of 6 October 2022 on the reform of the residential rental lease (bill no. 7642), which according to Luxembourg's Ministry of Housing aims to protect tenants against usurious rents, appears to not only cause significant effects on the residential rental market but is very likely to push up the real estate prices of old houses and apartments.

Calculations performed using the information provided at www.logement.lu on the current and post-reform "maximum annual rent ceiling" led to three key findings, of which the first was presented earlier. We found that the new rent agreements will be "lower" post-reform for only the five preceding years, meaning tenants will most likely benefit from a new lower maximum legal rent for houses and apartments which were acquired in 2016 or later.

While this new rent ceiling is expected to have a limited impact on the owners' overall rental income in the short to medium term, some homeowners with a floating interest rate home loan might find their budgets further squeezed with the sudden increase in monthly mortgage payments. To add numbers to thus perspective, according to the European Central bank (ECB), the home loan interest rate averages (weighted) in the euro area reached 2.26% in August 2022, already an increase of 71% compared to August 2021. Based on the ECB's current stance to keep increasing key lending rates (up 0.5% in July 2022 and up 0.75% in September 2022) to bring the double digit inflation rates under control, at least two more rate hikes are expected before December 2022. Together, this would increase home loan interest rates further and mortgage payments with floating rates could twice as high as a year back.

While it is still premature to make assumptions of the after-effects of higher home loan interest rates and consequently high mortgage payments on the rental market, it is anticipated that many first-time buyers will shy away from taking out a loan when the repayments are higher and thus continue to live in or look for rental properties. Meanwhile, many owners now burdened with higher mortgage payments and limited by a maximum rent ceiling would probably like to cash in on their investment by selling their houses or apartments, thus making fewer rental properties available in the market.

Back to the two remaining key findings concerning the amendments in the residential rental lease (bill no. 7642):

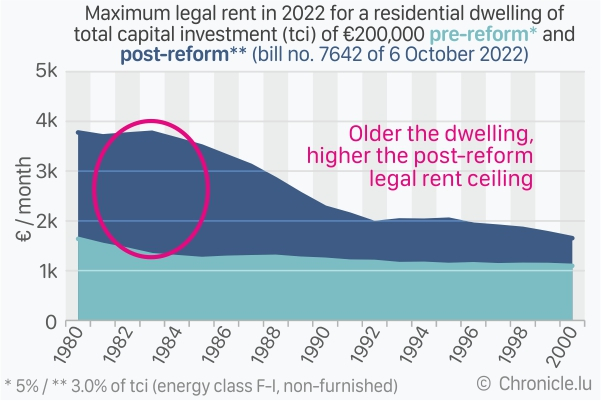

2. The older the dwelling, the higher the post-reform maximum annual rent ceiling becomes

Assuming a different scenario where the focus is on older houses and apartments available for rental lease, for example from the year 2000 or earlier, which represents dwellings older than 20 years and likely with an energy certificate category between F and I, the maximum legal rent was calculated for a total investment of €200,000 (half the amount in the previous scenario).

Interestingly, even with the maximum annual rent ceiling cut off at 3.0% of the capital invested and assuming no other expenses are acquired over the years, the post-reform maximum rent ceiling after the "discount" for a dwelling from the year 2000 will be 50% higher than the current maximum rent ceiling (€1,653 per month post-reform compared to €1,097 per month at the current applicable ceiling).

The effect further aggravates with older dwellings, for example, the maximum rent ceiling for residential properties from the 1980s with an energy class between F and I would increase by at least double the current legal maximum (an increase of 105% to 188% for dwellings between 1980 and 1989).

3. Post-reform legal maximum rent increases 16.6% further for dwellings with energy certificates between A and E

Keeping all the conditions similar to the above scenario but assuming the dwelling has an energy certificate between A and E, although the maximum annual rent ceiling increases by only 0.5% of the total capital invested (3.0% to 3.5%), the net effect on rents, after the "discount", increases by up to 16.6%.

As an example in absolute numbers, the new maximum legal rent in 2022 would be €276 higher (€1,929 per month) for a dwelling acquired in the year 2000 with energy class A-E compared to a dwelling with energy class F-I (€1,653 per month), a difference of 16.6% in maximum legal rent.

Justifiably, such added value in expected increase in rent income will encourage owners to switch to better energy certificates and thus decrease overall energy consumption as well as become more environmentally friendly in the long term. This may or may not be beneficial for a tenant with higher rents but low energy costs.

In summary, our calculations show that the new maximum legal rent ceiling will be at least two times higher than the current maximum legal rent ceiling for dwellings which have an energy certificate between A and E and were acquired in 1991 or earlier (and at least three times if acquired before 1978).