Credit: KPMG / ABBL

Credit: KPMG / ABBL

KPMG Luxembourg and the Luxembourg Bankers’ Association (ABBL) have joined forces to produce a comprehensive study aimed at providing a "State of the Nation" report on the private banking industry in Luxembourg and beyond.

Private banking has been at the heart of Luxembourg's financial sector for almost five decades. New developments and transformations have continuously helped this industry grow and reach new heights.

Private banks in Luxembourg

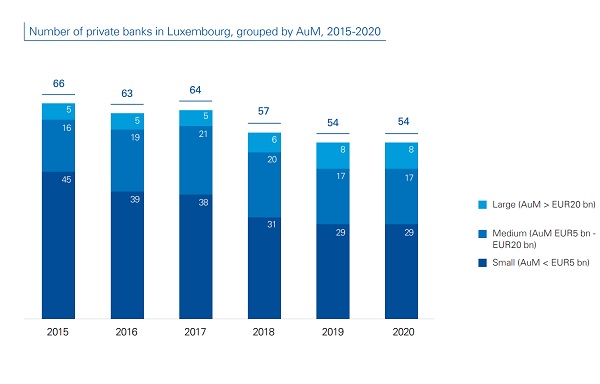

The net number of private banks in Luxembourg (taking into account mergers, wind-downs and new entrants) decreased by 18% between 2015 and 2020. While the total figure has been stable over the past two years, it is very likely, according to the report, that this downward trend will continue in the future. The decrease can be explained by a number of factors, all aligned and associated with the necessity for private banks to have a larger critical mass in terms of AuM and a leaner operating model allowing for a more balanced costincome ratio and, hence, a sounder financial performance.

Consequently, the net number of small private banks has decreased by 36% since 2015 (from 45 to 29), while the numbers of medium-sized and large banks have grown, organically and / or inorganically.

Assets under management

As a result of twelve consecutive years of growth, Luxembourg private banking assets under management (AuM) reached a total of €508 billion at the end of 2020 - more than double their 2008 level. Since 2008, the average annual growth in AuM has been 7.0% as, following a plateau between 2015 and 2017 (+1.7% per annum), the rate of increase accelerated to reach 13.4% per annum between 2018 and 2020.

Whether through organic growth or acquisitions, it is the large banks that have contributed most strongly to the growth in AuM, accounting for approximately 90% of the increase. In 2020, the largest private banks (those with over €20 billion AuM) represented approximately 47% of total AuM, while small banks (with under €5 billion AuM) only represented 9%.

On average, the Luxembourg private banks under review experienced a relatively strong AuM increase (+3.9%) to reach €11.6 billion despite the COVID-19 pandemic and its underlying impact on the economy. Moreover, operating revenues grew faster than costs, resulting in an overall decrease in the industry’s cost-income ratio (-2.4%) to 66.1%, as two-thirds of banks increased their operating profitability.

Overall, 12% of all private banks analysed (three-quarters of which belonged to the small cluster, i.e. AuM under €5 billion) were unprofitable in 2020.

Employment in private banking sector

Staff numbers in the Luxembourg private banking sector have decreased significantly since 2015 (down 7.7% overall). Moreover, this trend has accelerated since 2018 (falling at an average of 3% per annum) after a period of stagnation.

The full report is available at home.kpmg/lu.