Credit: BIL Investment Outlook 2021

Credit: BIL Investment Outlook 2021

The Banque Internationale à Luxembourg (BIL) has published its investment outlook for 2021 in a report entitled "The way we live now".

In this report, BIL investment experts discussed the new reality ushered in by the COVID-19 pandemic, the digital trends that will stick and the renewed focus on sustainability. They urged investors to stay perseverant and disciplined, noting that a long-term mindset is essential during times of turbulence. Even though the global economy is still recovering from one of the worst recessions on record, optimism should prevail: countries and industries have a rare occasion to fix what was broken and there will be many opportunities on the road towards a bright post-pandemic future.

An uneven recovery

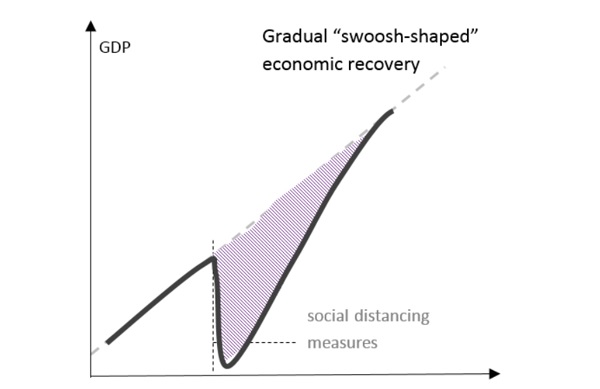

“The global economy fell into one of the worst recessions last year, but this was caused by government imposed lockdowns, rather than being the result of an economic imbalance,” said Fredrik Skoglund, Chief Investment Officer at BIL. “For 2021, we envisage a recovery resembling a “Nike swoosh” – for which the precipitous drop in 2020 activity will be followed by a gradual normalisation”.

Winged by fiscal and monetary support, major financial markets across the world have largely rebounded, despite the ongoing economic crisis. BIL experts expect the recovery to be uneven from one country to another. Its speed will be dependent upon the success of government containment measures and vaccination roll out and contingent upon continued policy support. At corporate level, two divergent paths are likely to occur: companies with a strong foothold in digitalisation will benefit from the pandemic, whilst companies whose business model have been turned upside down will not be able to operate at full capacity as long as social distancing is the modus operandi.

With public debt levels at record highs, BIL experts noted that policymakers could try to coax up inflation to offset some of the burden. This leaves central banks walking a tightrope: they want higher inflation, but they do not want it to go too high, knowing how painful it could be to bring it down again.

Fredrik Skoglund explained: “Monetary policy should continue to be easy in 2021 as the major central banks do not seem to have exhausted their policy jar. We expect 2021 to be a constructive year, one of rebuilding and of problem-solving, against a backdrop of ongoing policy support and strides towards inoculation”.

Diversification and long-term view

Equity markets are poised to benefit in such a context and BIL experts expect a slight upside, though much of this is already priced in. Investment style considerations will be important and investors must be prepared for an eventual value catch-up later during the year. With regard to sectors, a nuanced approach is warranted. The new digitalised reality ushered in by the pandemic means some companies will sink and some will swim within individual sectors. Selectivity to ensure the robustness of individual business models has never been more crucial, according to the experts.

With regards to fixed income, investors are hunting for yield and this should likely continue through 2021, with central banks almost certainly poised to keep interest rates lower for longer. According to BIL experts, investors should stay cognisant to the risks at hand. They should not get caught off guard by a modest uptick in inflation, since this is something central banks are trying to conjure.

“Even after coronavirus subsides, its legacy will remain. The way we live has been irreversibly altered. Trends accelerated by the pandemic such as digitalisation are unlikely to fall into reverse, portfolios must be fine-tuned accordingly,” added Fredrik Skoglund.

As disruptive as the pandemic has been, BIL experts maintained that it may prove to be a drop in the ocean compared to the challenge of climate change.

The BIL Investment Outlook 2021: The Way We Live Now is available on the BIL Investment Insights blog.