Total balance sheet of banks in EUR billion;

Credit: ABBL

Total balance sheet of banks in EUR billion;

Credit: ABBL

The Luxembourg Bankers' Association (ABBL) recently presented its annual results of the banking sector for 2024 and outlined key initiatives aimed at ensuring long-term resilience and competitiveness.

The ABBL reported that Luxembourg banks delivered strong results in 2024, achieving net profits of €7.24 billion, a year-on-year increase of 10%. This performance followed an “exceptional” 2023, according to ABBL Chairman Yves Stein, and reflected continued resilience amid geopolitical and economic uncertainty.

"The primary objective of all our members is to remain both sustainably profitable and sustainably compliant and in doing so to release sufficient resources to continue to stimulate the dynamism of businesses and contribute to collective prosperity", stated Yves Stein.

Banking sector overview

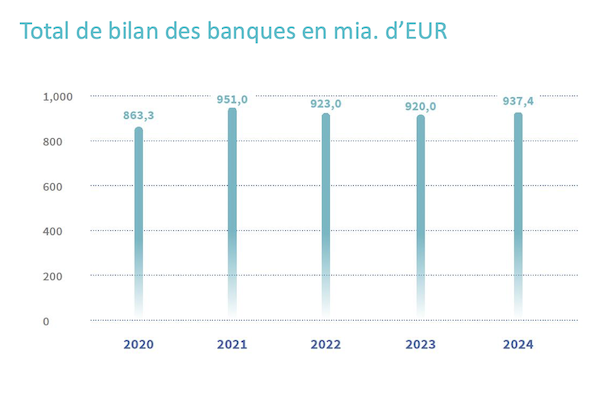

The total balance sheet of Luxembourg banks grew modestly by 1.89%, reaching €937.4 billion in 2024 (up from €920 billion in 2023). Employment remained stable with 26,148 employees, down by just 137 from the previous year. The number of banks declined slightly from 118 to 115, reflecting global consolidation trends.

The ABBL welcomed 25 new members in 2024, bringing the total to 266. This includes a diverse range of financial intermediaries beyond traditional banks, such as fintechs, investment firms and legal or consulting entities supporting the financial ecosystem.

Increased interest rates from the European Central Bank (ECB) continued to benefit banks. According to ABBL CEO Jerry Grbic: "The historically stable margin that banks earn on the debit and credit interest of their private customers represents only a small part of the total. The majority of the gains come from the capital that banks place with the ECB as prudential reserves or for investment purposes. After a decade of low or even negative interest rates, this capital has once again started to yield returns.”

Net interest margin income increased by 4.4% in 2024, following a 50.9% surge in 2023. Net fee and commission income also grew by 9.4%, while general expenses remained stable.

Regulatory simplification

The ABBL emphasised the need for "smarter regulation" rather than deregulation. The association released a position paper titled "Proposals towards smarter regulation in Europe," outlining 40 measures aimed at reducing complexity without compromising stability. These proposals were informed by input from banks, payment institutions and investment firms.

“In many cases, regulation ensures legal certainty and transparency for both private and professional investors — an increasingly strategic area where Europe can turn a constraint into an opportunity,” said Mr Grbic. "We are not asking for more regulation; we are calling for smarter regulation."

The ABBL expressed support for recent European discussions on competitiveness, including the Mario Draghi report to the European Commission, which identified the EU's regulatory density as a key factor undermining its financial sector's global position.

Cybersecurity and resilience

Cybersecurity remains a top priority, according to the ABBL. "Digitalisation, the rise of AI and an increasingly tense geopolitical environment are creating new risks," said Ananda Kautz, Head of Innovation, Payments and Sustainability at the ABBL. She noted a 20.8% increase in online fraud cases reported by Luxembourg police and cited EU data indicating 46% of all cyberattacks in 2023–24 targeted banks.

In response, ABBL members are strengthening digital resilience and customer protection. Efforts include the rollout of the Digital Operational Resilience Act (DORA), expansion of the 491010 hotline, transition from LuxTrust tokens to a mobile app and a pilot for the "Verification of Payee" system under the new instant payments directive.

A national anti-fraud working group was created in December 2024 by the ABBL, the ABBL Foundation and the House of Cybersecurity, with participation from the CSSF, BCL, ILR and BeeSecure. A national public awareness campaign will launch in 2025.

Despite global headwinds, the ABBL remains optimistic. The association sees Luxembourg banks well positioned to support the EU's digital and green transitions, provided regulatory frameworks enable flexibility and innovation. The ABBL said it is also advocating for a more competitive European financial sector and a shift toward a dual mission for supervisors: ensuring both stability and competitiveness.