Credit: LSFI

Credit: LSFI

The Luxembourg Sustainable Finance Initiative (LSFI), a non-profit association that designs and implements the Sustainable Finance Strategy for the Luxembourg financial centre, in collaboration with 2 Degrees Investing Initiative (2DII), published an overview of the country-wide Climate Scenario Analysis (“the Analysis”) undertaken between June 2021 and February 2022.

The Analysis targeted Luxembourg-based financial institutions and is the first country-wide coordinated climate scenario analysis in Luxembourg. With it, the LSFI and 2DII offered interested participants a free and fully anonymous tool to understand the alignment of their loan books and investment portfolios with the Paris Agreement’s objectives.

In this first analysis, the main objectives were to help participants get acquainted with climate scenario methodologies, raise awareness of climate change implications and help them anticipate future regulations. Considering these goals an essential step in this transitioning period, the participation was voluntary, and only participating institutions received their individual results.

“Action to combat climate change is urgently needed and it is now clear the financial sector has a pivotal role to play. To act, it is fundamental to understand the level of implication with respect to the Paris Agreement goals, have the know-how and include sustainability at the heart of each organisation. The Luxembourg 2021 Climate Scenario Analysis has been an important step in this direction: PACTA provided an actionable tool to measure the Paris Agreement alignment and upskill the staff.” said Nicoletta Centofanti, LSFI Sustainability Adviser.

The Paris Agreement Capital Transition (PACTA) methodology developed by the not-for-profit think tank 2DII was used to run the analysis. The analysis consisted of two parts: PACTA for Investors & PACTA for Banks, based on the organisation type and the assets analysed. Throughout the process, the 2DII team provided regular training and technical support; the LSFI team coordinated the project and the involved parties.

“The PACTA methodology seeks to help individual financial institutions to measure risks incurred in their portfolios by using climate-scenario analysis concepts in a free and open- source tool. However, when it comes to the climate crisis, no financial institution is an island - cooperation among actors in the financial sector and countries is needed. By running a climate scenario analysis at the country level, Luxembourg reaffirms its commitment as a leader in the sustainable finance debate. Jointly with the Luxembourg Sustainable Finance Initiative and the Luxembourgish financial institutions, we are ready to keep working to make finance flows consistent with a pathway toward low greenhouse gas emissions and climate-resilient development.” said Catarina Braga, 2DII Luxembourg Project Leader.

52 financial institutions representing the investment fund, insurance and bank industries took part in the analysis. A total of $957.3 billion assets under management were analysed.

Building on this analysis, the LSFI will launch in 2022 a Climate Measurement and Reporting Working Group to lead the future works of the LSFI on this pressing issue. The working group will be mandated with the general task of developing new climate-related initiatives to help promote and push this topic within the Luxembourg financial sector.

What does the Luxembourg 2021 Climate Scenario Analysis Overview include?

The Luxembourg 2021 Climate Scenario Analysis Overview released today outlines the objectives, the methodology, the timeline and the type of report provided to financial institutions. It also includes feedback from participating companies; for this Overview, the LSFI conducted an anonymous survey among interested institutions and interviewed some participants that agreed to share their experiences openly.

What were the main objectives of this first Luxembourg Analysis?

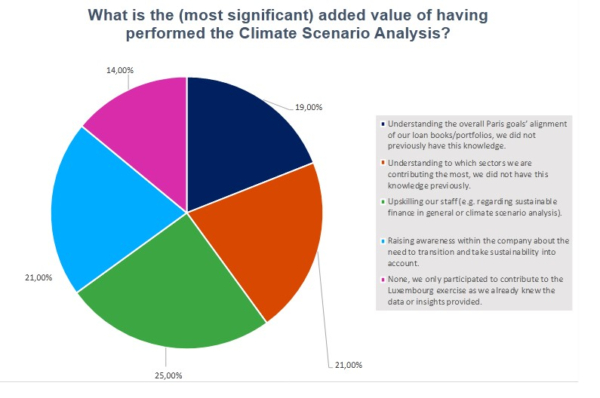

One of the main objectives of the Luxembourg Analysis was to get financial institutions acquainted with climate scenario analysis methodologies and train their staff. For financial institutions, these are a way to understand how resilient and flexible their portfolios are considering a range of plausible climate scenarios. 21% of the survey respondents indicated that the most significant added value of performing this analysis was to obtain information about the invested sectors that contribute the most to climate change. For 19%, it was to understand their alignment with the Paris Agreement goals, a piece of information they did not previously have.

It also aimed at helping put the climate change topic on their agendas: running the analysis was an opportunity for participating institutions to organise internal informative/awareness- raising sessions on the climate crisis topic and its link with the financial industry. 25% of the survey respondents agreed that the most significant benefit of running PACTA for them was to upskill their staff and for 21% to raise awareness.

The Luxembourg Analysis also intended to help the financial sector anticipate future regulations linked to Luxembourg and Europe’s pledge to be climate neutral by 2050, which will require such measurements.

What is the PACTA Methodology?

PACTA is an open-source methodology based on forward-looking asset-level data to support company engagement. It allows financial institutions to understand the alignment of their loan books and investment portfolios with the Paris Agreement’s objectives. It covers eight climate- relevant sectors: power, automotive manufacturing, oil & gas, coal mining, aviation, shipping, cement, and steel. These sectors contribute to 70-90% of GHG emissions.

This methodology has also been used successfully in Switzerland, Norway, Austria and Liechtenstein, among others.

The “Luxembourg 2021 Climate Scenario Analysis – An Overview” is available online via: https://lsfi.lu/luxembourg-2021-climate-scenario-analysis-an-overview/