Share of environmental tax (%) out of total revenue from taxes and social contributions in EU in 2020;

Share of environmental tax (%) out of total revenue from taxes and social contributions in EU in 2020;

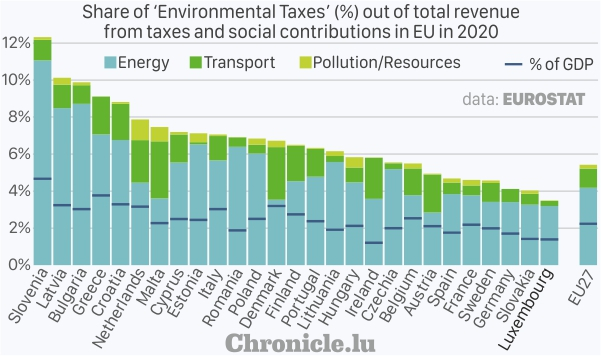

In 2020, environmental tax revenue in Luxembourg amounted to €893 million, corresponding to 3.49% of total revenue from taxes and social contributions - the lowest share across the European Uniion (EU).

The highest share of environmental tax revenue was recorded in Slovenia at 12.32% followed by Latvia at 10.12%. The EU average stood at 5.4%.

Environmental tax is something that has a proven and specific negative impact on the environment and European statistics distinguish four different categories of environmental taxes relating to energy, transport, pollution and resources.

The majority of the environmental tax revenue comes from energy taxes, at 77.2% for EU (in 2020). In Luxembourg, the energy taxes accounted for 91.6% of the total revenue from environmental taxes in 2020.

Most countries reported a decrease in energy taxes compared with 2019 and the typical range of decrease was between 5% and 15%.

Corporations paid 51.5% of all energy tax revenue collected by governments in 2019, followed by households at 44.0% and the remainder (4.5%) were payable by non-residents or could not be allocated to a specific group.

In terms of gross domestic product (GDP), the total environmental tax collection represented 2.24% of EU GDP in 2020. For Luxembourg, this represented 1.39% of GDP in 2020.

Slovenia (4.67%), Greece (3.77%), Croatia (3.29%) and Latvia (3.23%) recorded the largest environmental tax revenue-to-GDP ratios in the EU, whereas Germany (1.71%), Slovakia (1.42%), Luxembourg (1.39%) and Ireland (1.21%) recorded the smallest shares.