Consumer Confidence;

Credit: Statec

Consumer Confidence;

Credit: Statec

On Tuesday 25 February 2025, Luxembourg’s statistics institute, STATEC, published a report indicating what they describe as a recovery of morale amongst service companies in Luxembourg.

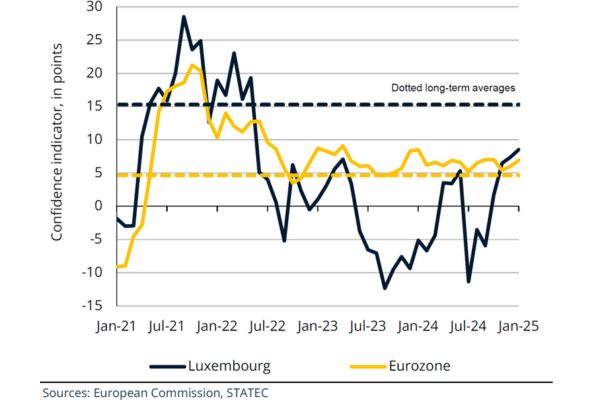

In the report, the organisation stated that a survey, conducted in January 2025, showed that, after falling sharply in the third quarter (Q3) of 2024, morale has recovered among service companies in Luxembourg. The confidence indicator is reported to have risen for the fourth consecutive month and reached its highest level in the past two and a half years.

STATEC confirmed that the recovery is evident in all three components of the confidence indicator (evolution in the company's situation, recent demand and anticipated demand), particularly in legal and accounting activities, air transport, catering, postal and courier services, leasing and administrative and business support. However, it added that no improvement had been observed for land transport companies, warehousing companies, housing, IT programming and consulting, or head office and management consultancy services. The upturn in service morale in Luxembourg is thus not generalised (across all sectors) for the moment and the current level of confidence remains below average. Other significant findings from the survey include an improvement in employment trends (both recent and anticipated) over the past few months and a fall in the proportion of companies pointing to financial constraints.

STATEC noted that, in the eurozone, confidence in services has fluctuated slightly above its long-term average since the start of 2024, without any clear direction. It reported that confidence rose marginally in December and January, mainly due to an improvement in results in Italy. In the retail sector, which is the subject of a specific business survey, the trends noted in Luxembourg are fairly similar to those for other services: a relatively marked fall in confidence among retailers in the third quarter of 2024, followed by a recovery in Q4. This recent improvement is reflected in the sales trends and inventory levels components of the confidence indicator. However, this sentiment has not been accompanied by a more favourable employment outlook. In the eurozone, retail confidence has also been trending upwards since the fourth quarter (Q4) of 2024, but this growing optimism is not widespread. STATEC added that his change has not been observed in the three countries bordering Luxembourg.

STATEC stated that industrial companies in Luxembourg have experienced a minor upturn in their morale since mid-2023 (slightly bucking the trend in Europe, which remains on a downward spiral). However, the figures are described as continuing to fluctuate sharply from one month to the next. The general climate for industry in Europe is reported to remain gloomy, undermined by weak demand for investment and capital goods, high energy costs and the pressure of international competition.

STATEC added that business confidence in Luxembourg's construction industry continued to drop. At the start of 2025, it reached its lowest level since the 2009 financial crisis. According to the report, around 60% of companies in the sector are currently reporting insufficient demand, in comparison to 10% at the start of 2022