Credit: STATEC

Credit: STATEC

On Tuesday 25 October 2022, Luxembourg’s statistics agency, STATEC, confirmed in its monthy report that the economic situation in Europe has continued to deteriorate, suggesting the possibility of an economic recession.

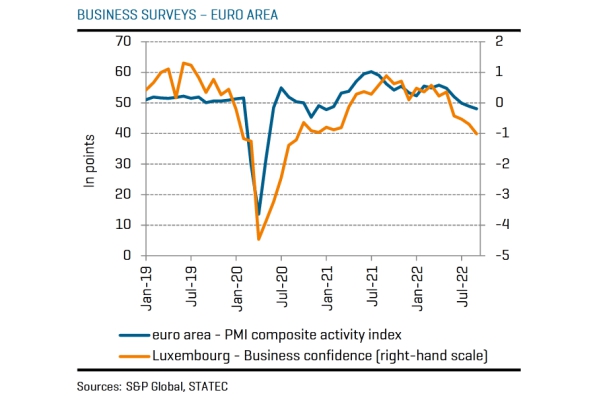

According to STATEC, while business activity in the euro area, which benefited from the lifting of restrictions, remained resilient in the second quarter of 2022, it fell in Luxembourg. The composite PMI (Purchasing Managers’ Index) suggests that both industry and service activities have been contracting since July 2022, pointing to a decline in euro area GDP of around 0.1% quarter-on-quarter in the third quarter of 2022. Moreover, unless economic activity rebounds in the next few months, the downturn will be even more pronounced in the fourth quarter, which would mean that the euro area has entered a recession.

STATEC clarified that the consumer sentiment has dropped to its lowest level on record in September 2022, both for the euro area as a whole and in Luxembourg. Household opinions declined the most with regard to their personal financial situation (recent and anticipated). These concerns are directly linked to the inflation situation and in particular to the rise in energy prices, which was exacerbated by the consequences of the war in Ukraine. Companies are also affected by rising energy prices when they are unable to price these increases into their products, which means that they have to cut their margins. Plans to support the household and business purchasing power have been put in place in most European countries with the aim of mitigating the effects of this energy shock, but these measures have not been able to fully offset the impact. This situation has led to a surge in demands for higher wages in recent months in the European Union (EU) Member States.

According to STATEC, the European Central Bank’s (ECB’s) interest rate hikes have been very rapid and very sharp (50 basis points in July and then an unprecedented 75 points in September 2022). This significant tightening of European monetary policy is not taking place in a context of economic overheating in Europe, but in a context of price increases that are largely due to external factors, underscored STATEC. This will weigh on the financing capacity of households and companies and add to the recessionary dynamic by having only an indirect effect on energy prices (via a fall in European demand). And while oil prices and (to a greater extent) gas prices have resumed a downward trend in recent weeks, there are many other factors behind this trend.

Decline in Luxembourg’s GDP in Q2 of 2022

Luxembourg’s GDP fell by 0.5% quarter-on-quarter in the second quarter (Q2) of 2022 (after an increase of 0.7% in Q1). The most negative contributions were seen in the industry and construction sectors, which had performed relatively well in the first quarter. The financial sector was up 2.4% quarter-on-quarter compared with a drop of almost 4% in Q1, but the sector’s value added in volume terms remains below the levels reached at the end of 2021, which reflects in particular the deterioration of the stock market environment. Household consumption fell in Q2 ( down0.4% quarter-on-quarter), as did investment (down 5.4%, mainly due to lower construction volumes). Based on these results and assuming that GDP stabilises at its Q2 level over the rest of the year, STATEC estimates a GDP growth of 1.6% for 2022.

This decline in GDP contrasts with the 0.7% increase recorded in the euro area in Q2. However, the lifting of health restrictions has particularly boosted the activity of countries with a significant number of tourists (as shown by the excellent results of France, Spain and Italy, in particular), which is not the case for the economy of the Grand Duchy.

Sharp decrease in gas consumption

Luxembourg consumed about 20% less gas from January to September 2022 than it did on average over the last five years. One third of this reduction is due to the closure of a glass industry plant and the replacement of a furnace that was reaching the end of its life. Another third is accounted for by around 20 energy-intensive companies, where a decline in industrial production can be observed since June 2022. This development could reflect a loss of competitiveness following the surge in gas prices through August 2022. The remaining third is attributable to lower gas use for heating: the number of heating degree days was 5% lower than the average over the previous five years.

With an effective decrease in consumption of 36% and 26% for August and September 2022 respectively, Luxembourg is on track to meet the European objective of reducing gas consumption by at least 15% between August 2022 and March 2023. Heating accounts for two thirds of gas consumption during the winter and the key factors will be how severe the winter will be and how successful efforts to reduce gas consumption are, elaborated STATEC.

House prices increases are slowing

Selling prices for housing rose by 11.5% year-on-year in the second quarter of 2022, compared with 10.3% in the first quarter. However, the fundamental trend continues to be a slowdown, particularly in the case of the prices of existing housing. The number of transactions involving new real estate (where prices are more volatile) is tending to fall, as in previous quarters. The pace of housing price inflation in the euro area seems to have peaked, and the economic context (rising interest rates, high inflation) is likely to lead to a more pronounced slowdown in the coming quarters. The bank credit survey conducted in July 2022 shows that demand for home mortgages is declining in Luxembourg and the euro area.

Fixed rates at ten years or more applied to new mortgages in Luxembourg rose to an average of 2.9% in August 2022 (up 1.4% year-on-year). Nevertheless, 30-year fixed rates stabilised at 3.5% in Q3, according to AtHome. Variable rates remained stable at around 1.4% on average in August 2022, but are reported to have risen to 2% at the end of September 2022, following the ECB’s key rate hikes.

Unemployment rises again

Unemployment is again on the rise in seven of the nineteen euro area countries, including Luxembourg. The increase in unemployment is particularly high in Finland and Austria (up 1% since their last low point), as well as in the Netherlands and Belgium (up 0.5%). As unemployment continues to fall in the “heavyweights” (Spain, Italy and Germany, in particular), the rate for the euro area as a whole remained stable or decreased slightly, at least through August 2022 (latest data available).

In Luxembourg, the increase in unemployment remains limited for the moment (from 4.7% of the active population in April-July to 4.8% in August and September 2022), and the level of unemployment remains historically low. However, the trend is upwards and should become more pronounced over the coming months. In addition, while unemployment stabilised in the spring through the registration of Ukrainian refugees, the rise in the last two months has been mainly due to other categories (in particular young people). Job creation remains strong in Q3 2022 (with employment increasing by 0.6% quarter-on-quarter), but again the trend is towards a slowdown (up 0.9% in Q1 and up 0.8% in Q2).

Good performance of tax receipts

Tax revenues collected by the government in the first three quarters of the year are up 7.5% year-on-year (down 1.4% over one quarter). The projected increase in tax revenue collected over the full year 2022 may be somewhat lower for methodological reasons (lag between collection and the reference period) as well as because the last quarter of 2021 was particularly strong, driven by wage indexation.

Revenues in Q3 2022 were boosted by a rebound in corporate taxes (up 6% quarter-on-quarter) and by VAT revenues, which were buoyed by inflation. Social contributions and household taxes were boosted by the April 2022 indexation (up 7.6% and up 14%, respectively, year-on-year in the first half of 2022). By contrast, subscription tax revenues stagnated in Q2 and Q3 (down 8.1% year-on-year in Q3) with the decline in assets under management of investment funds (down 6% year-on-year in August 2022). Excise duties also declined in Q2 and Q3 due to the temporary reduction in autonomous excise duties on gasoline and diesel, and the downward trend in fuel sales.

The full report is available online via: https://statistiques.public.lu/en/publications/series/conjoncture-flash/2022/10-22-conjflash.html.