Credit: CSSF

Credit: CSSF

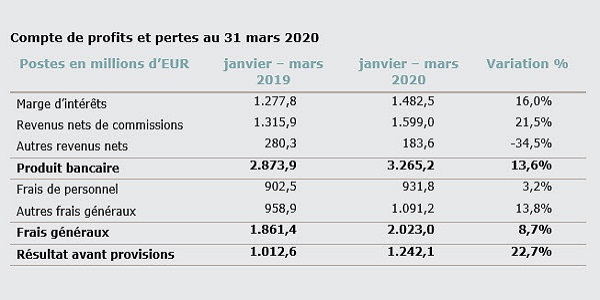

Luxembourg's financial regulator, the Commission de Surveillance du Secteur Financier (CSSF) has estimated the result before provisions of the country's banking sector at €1.242.1 million for the first quarter of 2020; in annual comparison, the result before provisions increased sharply by 22.7%.

The increase in operating profit before provisions and taxes should be put into perspective in the face of an increase in value adjustments on the credit portfolios to be forecast in the coming months due to the health crisis.

In the first quarter of 2020, the interest margin increased by 16% compared to the same period in 2019. This increase is mainly explained by the growth in the aggregate balance sheet, part of which is linked to Brexit. For net commission income, the increase reached 21.5%. Although the value of assets deposited with banks fell sharply in February and March 2020, it remained, on average over the first three months of the year, higher than the average amount of assets on deposit in the first quarter of 2019. In addition, the volatility of the markets has generated more transactions and, consequently, increased commission income. Other net income fell sharply in relative terms (-34.5%) due to the decrease in the value of securities portfolios of certain banks.

General expenses continued to increase sharply (+8.7%) mainly due to the increase in other general expenses (+13.8%). Part of this increase was related to Brexit due to the relocation of operational infrastructure to Luxembourg.