Credit: BIL 2019 Financial Report

Credit: BIL 2019 Financial Report

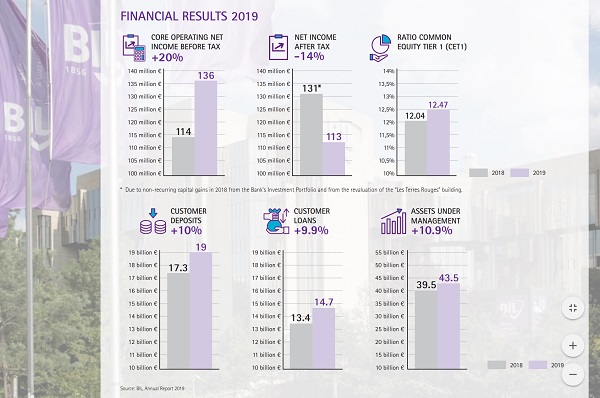

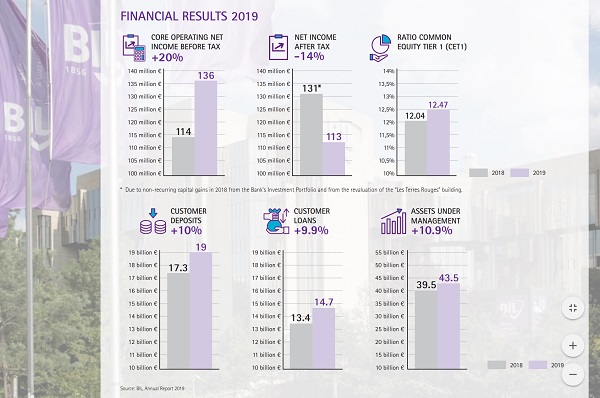

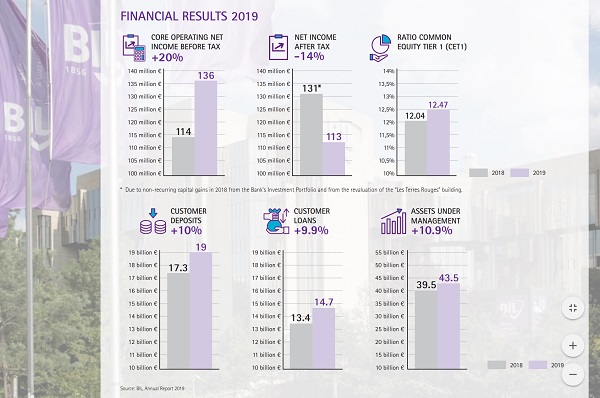

Banque Internationale à Luxembourg SA (BIL) announced today its financial results for the year 2019, recording a good performance of all business lines with a 20% increase in core operating net income before tax.

BIL’s commercial business lines delivered a solid performance in 2019. Core operating net income before tax (excluding non-recurring items) reached €136 million compared with €114 million in 2018, which represents an increase of €23 million (20%). This positive result was further enhanced through cost containment measures and a limited cost of risk.

Net income after tax amounted to €113 million, 14% less than in 2018 (€131 million). This has been attributed mainly to large non-recurring capital gains in 2018 from the bank’s Investment Portfolio and from the revaluation of the “Les Terres Rouges” building complex which was divested in 2019.

Assets under management (AuM) increased by 10.3%, reaching €43.5 billion compared with €39.5 billion at the end of 2018. This increase resulted from new net inflows of €1.4 billion across all business lines and from a highly positive market effect of €2.6 billion due to favourable market conditions in 2019.

Similarly, customer deposits increased by 10%, reaching €19 billion and customer loans by 9.9% to €14.7 billion. Loan growth was essentially due to the commercial activities’ contribution which increased by €1.4 billion (+10.3% compared with year-end 2018).

CEO Marcel Leyers commented: “We are very pleased with this good business performance, it shows that our focus on bringing innovative solutions to our clients is bearing fruit. While we already know that 2020 will be challenging, we will continue to support our clients - be they individuals or businesses - throughout this crisis to help rekindle sustainable economic growth”.

Luc Frieden, Chairman of the Board of Directors of BIL Group, added: “In 2019, with the support of our shareholders Legend Holdings and the State of Luxembourg, the Bank launched a new five-year strategic plan. Despite the many global and national challenges ahead of us, BIL, as a leading universal bank, will continue to innovate, to support the Luxembourgish economy and to develop its franchise”.

The high quality of BIL’s services was recognised externally by awards such as “Best Bank in Luxembourg 2019” by Global Finance and “Bank of the Year Luxembourg” by The Banker magazine.

In addition, the bank launched a new strategic plan in 2019 which foresees investments of €400 million until 2025. BIL confirmed its desire to position itself as an innovative bank on its Luxembourgish home market whilst developing the international wealth management and corporate banking offering.

Credit: BIL 2019 Financial Report

Credit: BIL 2019 Financial Report

Credit: BIL 2019 Financial Report

Credit: BIL 2019 Financial Report