Consolidated profit and loss account;

Credit: BNP Paribas

Consolidated profit and loss account;

Credit: BNP Paribas

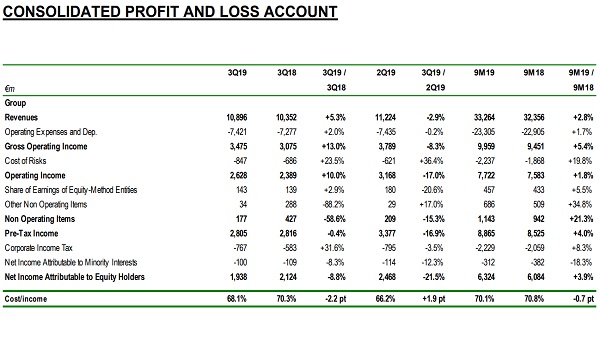

On Wednesday 30 October 2019, the Board of Directors of BNP Paribas examined the Group’s results for the third quarter of 2019.

The business of BNP Paribas was up this quarter in all the operating divisions in a context where economic growth slowed down but remained positive in Europe, particularly in France. The new monetary policy measures occurred at the end of the quarter and they will produce their full effect only in 2020. Revenues, at €10,896 million, were up by 5.3% compared to the third quarter of 2019 (+4.0% at constant scope and exchange rates). In this context, the revenues of the operating divisions were also up by 5.1%, with an increase in all divisions: +0.5% at Domestic Markets; +5.1% at International Financial Services; +12.0% at CIB.

At €7,421 million, the Group’s overheads were up by 2.0% compared to the third quarter of 2019 (+0.4% at constant scope and exchange rates). These included the exceptional impact of the 2020 plan transformation costs (€178 million), restructuring costs of acquisitions (€48 million ) and additional adaptation measures in BNL bc and Asset Management (€30 million for departure plans), which totalled €256 million (compared to €267 million in the third quarter of 2018). Similarly, the operating expenses of the operating divisions rose by 2.9% compared to the third quarter of 2018.

The gross operating income of the Group thus totalled €3,475 million, up by 13.0%. In addition, this was up by 3.9% for operating divisions, whilst the cost of risk, at €847 million, was up €161 million compared to the third quarter of 2018. The Group’s operating income, at € 2,628 million, was thus up by 10.0%; it was up by 6.1% for operating divisions.

In total, the Group’s net income attributable to equity holders was thus €6,324 million, up by 3.9% compared to the first nine months of 2018 (+1.1% excluding exceptional items).

In addition, Domestic Markets' (including Luxembourg) specialised businesses continued their strong growth: the fleet financed by Arval grew by 8.7% and the financing outstandings of Leasing Solutions were up by 6.0% compared to the third quarter of 2018. Personal Investors reported increased assets under management (+6.4% compared to 30 September 2018) and Nickel continued its very strong growth with 85,000 accounts opened this quarter (over 1.4 million accounts opened as at 30 September 2019).

The outstanding loans of Luxembourg Retail Banking (LRB) rose by 9.1% compared to the third quarter of 2018, with good growth in mortgage and corporate loans. Deposits were up by 8.1% with a significant rise in sight deposits in particular in the corporate client segment. The business enhanced the customer experience for mortgage loans by simplifying journeys. In totat, the revenues of the five businesses (including 100% of Private Banking in Luxembourg), which totalled €807 million, were up on the whole by 6.9% compared to the third quarter of 2018 with business growth in all the businesses.