Credit: BGL BNP Paribas

Credit: BGL BNP Paribas

On Tuesday 30 July 2019, the Board of Directors of BGL BNP Paribas examined the Group’s results for the second quarter of 2019 and endorsed the interim financial statements for the first half of the year.

2019 Q1

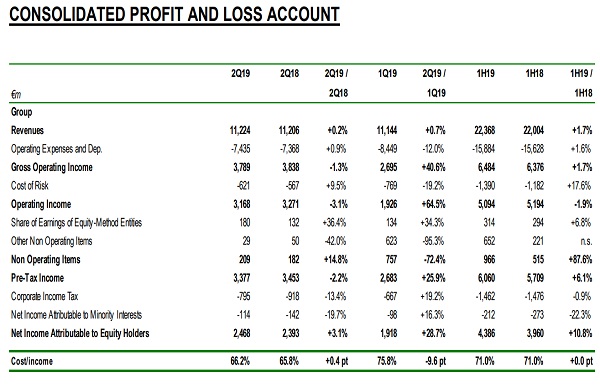

The business of BGL BNP Paribas was up this quarter in a context where economic growth remained positive in Europe but slowed down, implying expectations of a continued low interest rate environment. Revenues, at €11,224 million, were up by 0.2% compared to the second quarter of 2018. In this context, the revenues of the operating divisions were also up by 2.5% (+1.4% at constant scope and exchange rates).

At €7,435 million, the Group’s overheads were up by 0.9% compared to the second quarter of 2018. These included the exceptional impact of the 2020 plan transformation costs (€222 million), restructuring costs of acquisitions (€63 million) and additional adaptation measures in BNL bc and Asset Management (€51 million for departure plans), which totalled €336 million euros (compared to €275 million in the second quarter of 2018). Excluding these exceptional items, costs rose by only 0.1%, generating a positive jaws effect.

The gross operating income of the Group thus totalled €3,789 million, down by 1.3%. Nevertheless, this was up by 3.9% for operating divisions. Meanwhile, the cost of risk, at €621 million, was up €54 million compared to the second quarter 2018 due to the increase of outstanding loans. The Group’s operating income, at €3,168 million (€3,271 million in the second quarter of 2018), was thus down by 3.1%; it was up by 2.2% for operating divisions.

In total, the Group’s net income attributable to equity holders was thus €2,468 million, up by 3.1% compared to the second quarter of 2018.

First half of 2019

For the first half of the year, revenues, at €22,368 million, were up by 1.7% whilst overheads, at €15,884 million, were up by 1.6% compared to the first half of 2018, thus generating a positive jaws effect.

The gross operating income of the Group thus totalled €6,484 million, up by 1.7%; it was up by 5.5% for operating divisions. Similarly, the cost of risk, at €1,390 million, was up by €208 million compared to the first half of 2018 due to the increase of outstanding loans and provision write-backs at CIB and Personal Finance during the same period last year.

On the other hand, the Group’s operating income, at €5,094 million (compared to €5,194 million in the first half of 2018), was down by 1.9%; it was up by 2.3% for operating divisions. Non-operating items totalled €966 million (€515 million euros in the first half of 2018).

The Group’s net income attributable to equity holders was thus €4,386 million, up by 10.8% compared to the first half of 2018. The annualised return on equity was 9.6%, whilst the annualised return on tangible equity came to 11.0%.