Credit: BNP Paribas

Credit: BNP Paribas

Outstanding loans in the Luxembourg Retail Banking (LRB) sector have risen by 7.9% over one year, according to a report published by BNP Paribas.

The report, summarising the bank's results for 2018, revealed that outstanding loans in the LRB sector rose almost 8% in the fourth quarter of last year compared to 2017, with good growth in mortgage and corporate loans. Deposits were up by 11.8% with very good inflows in particular in the corporate segment. Digital development continued with the growing use of e-signature at Leasing Solutions and Arval as well as the rollout by Arval in Europe of an offering to individuals, already operational in the Netherlands, to rent cars online (Private Lease).

For the whole of 2018, the business activity of domestic markets was on the rise. Outstanding loans rose by 4.9% compared to 2017 with good growth in loans both in the domestic networks and in the specialised businesses (Arval, Leasing Solutions). Meanwhile, deposits rose by 5.2% compared to 2017 and were up in all countries. There were also good net asset inflows in Private Banking (€4.4 billion).

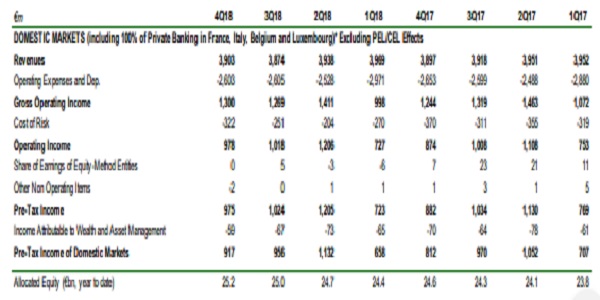

The revenues of the five domestic businesses, which totalled €2,986 million, were up on the whole by 7.3% compared to 2017 due to scope effects and good business development. Operating expenses rose by 10.6% compared to 2017, to €1,779 million, as a result of scope effects and development of the businesses as well as the costs to launch new digital services. The cost of risk, at €123 million, was up by €34 million compared to 2017. Thus, the pre-tax income of these five business units, after allocating one-third of Luxembourg Private Banking’s net income to the Wealth Management business, was €1,064 million (-5.4% compared to 2017). In the fourth quarter 2018, the revenues of the five businesses, which totalled €771 million, were up on the whole by 5.6% compared to the fourth quarter 2017 due to good business development and scope effects. Operating expenses rose by 5.5% compared to the fourth quarter 2017, to €443 million as a result of scope effects, business development and the costs to launch new digital services at Arval and Leasing Services. The jaws effect was thus positive by 0.1 point this quarter. The cost of risk was down by €1 million compared to the fourth quarter 2017, at €29 million. Thus, the pre-tax income, after allocating one-third of Luxembourg Private Banking’s net income to the Wealth Management business, totalled €289 million (+2.3% compared to the fourth quarter of 2017).

At the European level, BNP Paribas saw business increase in an environment of economic growth, outstnading loans up 3.9% (compared to 2017) and 2017 revenues of the various divisions held up well despite low rates and an unfavourable financial market context. 2018 similarly saw the development of the specialised businesses of domestic markets and international financial markets, decreased costs in retail networks and CIB (operating expenses of the operating divisions increased by 1.7%) and a decrease (-4.9%) of the cost of risk compared to the previous year.