2019 Results;

Credit: Shurgard Self-Storage

2019 Results;

Credit: Shurgard Self-Storage

Shurgard Self-Storage, a Luxembourg-based company offering self-storage units, today published its results for the year ended 31 December 2019.

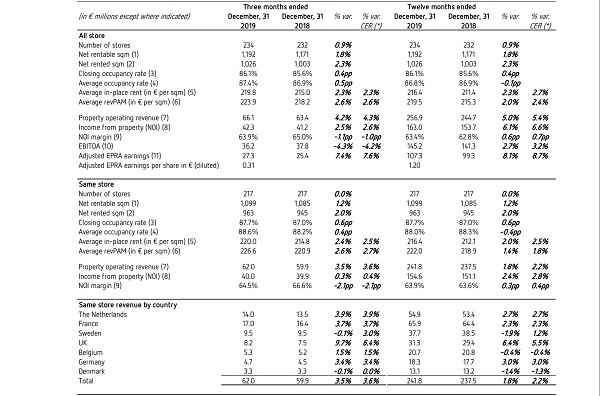

The company's property operating revenue for the year 2019 grew by 5.4%, with same store property operating revenue having increased by 2.2%. The company similarly reported growth of 6.6% of income from property (NOI) in 2019 and the same store NOI margin reached 63.9%, up 0.4% over one year.

The company also reported a delivery of €107.3 million of adjusted EPRA earnings, which represents an increase of 8.7%. The proposed total dividend for the year is €0.95 per share. On the other hand, an EBITDA growth of 3.2% negatively impacted due to one-off real estate tax accrual.

For the fourth quarter of 2019, property operating revenue grew by 4.3%, with income from property (NOI) growth for the quarter being 2.6%. Same store property operating revenue growth for the quarter was 3.6% at constant exchange rate (CER), whilst the all store NOI growth of 2.6% would have been 3.6% excluding real estate tax accrual. EBITDA was also negatively impacted due to one-offs; excluding these, EBITDA growth would have been 6.6%.

Moreover, Shurgard Self-Storage invested a total amount of €73 million in 2019. It also reported an undrawn revolving credit facility for €250 million, which is set to mature in 2023. The company's cash position was €198.6 million as of 31 December 2019.

In addition, the company finalised three redevelopments in 2019 (5,200sqm) for €10.0 million in London and Paris. Similarly, there were two openings in 2019 (11,900sqm) for €25.5 million in London and Utrecht (the Netherlands), generating an expected property yield between 8-10% at maturity. The company also secured four deals leading to the acquisition of five properties (17,600sqm) for a total amount of €43.2 million and to two properties under management contracts in Paris (with one ending in December 2020). Of the five acquired properties, three are in the Netherlands and two are in Paris (purchase completed in January 2020), generating an expected property yield between 8-10% at maturity.

Commenting on these results, Marc Oursin, Shurgard’s Chief Executive Officer, said: “We are pleased to report solid set of results for the year with revenue growth of 5.4% (at CER) and same store revenue growth of 2.2% (at CER) compared to last year. Our adjusted EPRA earnings grew by 8.7% (at CER). Shurgard expands in the Netherlands with three acquired properties, in Paris with four properties under management contracts, of which two have been acquired in January 2020. These deals support our growth strategy, which includes targeted acquisitions and a robust pipeline equivalent to 8% of our total footprint. Our strong balance sheet and financial position allow Shurgard to seize multiple opportunities and to strengthen our organic growth”.

Four more redevelopments are planned for 2020 (2,300sqm) in London, Paris and the South of France. The opening of six projects under construction (38,300sqm) in London, Paris and Berlin are similarly scheduled for 2020. The company signed an additional four projects (22,000sqm) in London, Paris, Berlin and Cologne, set to open in 2021.