Credit: Kangkan Halder

Credit: Kangkan Halder

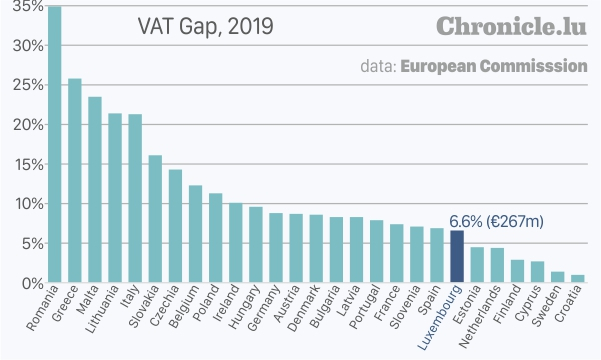

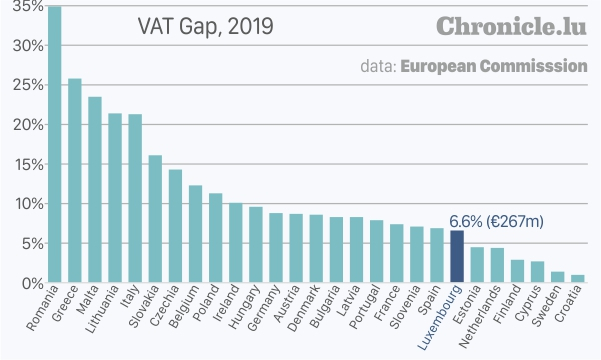

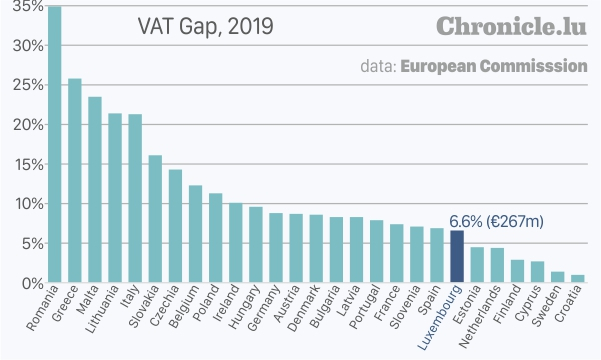

The European Commission has reported that Luxembourg lost €267 million in Value-Added Tax (VAT) revenues in 2019.

European Union (EU) Member States lost an estimated €134 billion in VAT in 2019, according to a new report released by the European Commission on Thursday. This figure represents revenues lost to VAT fraud and evasion, VAT avoidance and optimisation practices, bankruptcies and financial insolvencies, as well as miscalculations and administrative errors. While some revenue losses are impossible to avoid, decisive action and targeted policy responses could make a real difference, particularly when it comes to non-compliance.

Lost VAT revenues have an extremely negative impact on government spending in public goods and services upon which we all depend, such as schools, hospitals and transport. According to the Commission, the missing VAT could also prove beneficial as Member States strive to cover debt incurred during the initial recovery from the COVID-19 pandemic, or raise their climate financing ambitions.

Paolo Gentiloni, Commissioner for Economy, commented: "Despite the positive trend registered in the last few years, the VAT Gap remains a major concern – particularly in view of the immense investment needs our Member States must address in the coming years. This year's figures correspond to a loss of more than €4,000 per second. These are unacceptable losses for national budgets, and mean that ordinary people and businesses are left to pick up the shortfall through other taxes to pay for vital public services. We need to make a joint effort to crack down on VAT fraud, a serious crime that takes money out of consumers' pockets, undermines our welfare systems and depletes government coffers".

Following continued efforts to improve the situation both at EU and national level, the relative positive trend continued in 2019 with the overall VAT Gap in EU Member States decreasing by around €7 billion compared to the previous year. The EU has already made significant efforts to improve the way VAT is collected. The Commission has also supported Member States in working better together in the "Eurofisc" network, comprised of national officials from the 27 Member States and Norway. Since 2019, members of the network actively use the Transaction Network Analysis (TNA) tool financed by the EU to rapidly exchange and jointly process VAT data, allowing them to automatically detect cross-border VAT fraud at a much earlier stage. In 2022, the Commission will also launch legislative proposals to further modernise the VAT system, including the reinforcement of Eurofisc.

In nominal terms, the overall EU VAT Gap decreased by almost €6.6 billion to €134 billion in 2019, a marked improvement on the previous year's decrease of €4.6 billion. Though the overall VAT Gap has been improving between 2015 and 2019, the full extent of the COVID-19 pandemic on consumer demand and therefore VAT revenues in 2020 remains unknown.

In 2019, Romania recorded the highest national VAT compliance gap with 34.9% of VAT revenues going missing in 2019, followed by Greece (25.8%) and Malta (23.5%). The smallest gaps were observed in Croatia (1.0%), Sweden (1.4%), and Cyprus (2.7%). In absolute terms, the highest VAT compliance gaps were recorded in Italy (€30.1 billion) and Germany (€23.4 billion). Luxembourg's VAT revenue loss increased to 6.6%, or €267 million, in 2019.

In most Member States, the absolute year-over-year change in the VAT Gap was lower than 2 percentage points. Overall, the VAT Gap share decreased in eighteen Member States. In addition to Croatia and Cyprus, the most significant decreases in the VAT Gap occurred in Greece, Lithuania, Bulgaria and Slovakia (between –3.2 and -2.2 percentage points in these four countries). Sweden, Finland and Estonia were successful from a different perspective: in these countries, fiscal authorities have for years succeeded in limiting the loss in VAT revenues to less than 5% of the VAT due. The biggest increases in the VAT Gap were observed in Malta (+5.4 percentage points), in Slovenia (+3 percentage points) and in Romania (+2.3 percentage points).

Credit: Kangkan Halder

Credit: Kangkan Halder

Credit: Kangkan Halder

Credit: Kangkan Halder