Credit: ILR

Credit: ILR

On Tuesday 18 November 2025, the Luxembourg Regulatory Institute (ILR) published its statistical report on postal services in Luxembourg in 2024.

According to the report, parcel services, closely linked to e-commerce, showed steady and sustained growth in traffic together with stagnation in revenue, while the downward trend continued for letter services, in terms of both traffic and revenue.

The report presents key figures for the postal services market for 2024 and its development since 2021. The document is based on data collected from 43 providers active on the Luxembourg postal services market.

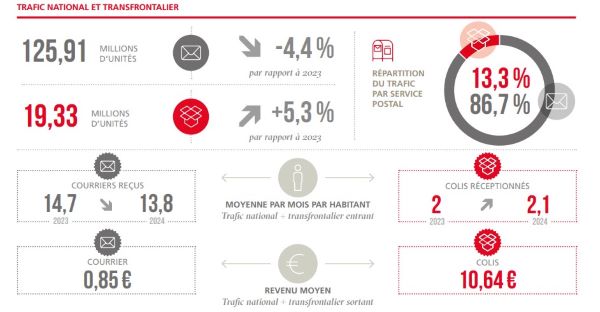

In 2024, letter services represented a volume of 125.91 million items, down 4.4% compared to 2023. Domestic traffic, representing 79.6% of total traffic, recorded a decrease of 2.6% over one year, while letter traffic continued to decline at a compound annual rate of 4.8% over the 2021-2024 period.

The universal service provider, POST Luxembourg, handled 96.6% of total letter traffic. Revenue from letter services stood at €110 million, a decrease of 4.6% compared to 2023. This decline follows a multi-year downward trend, interrupted only during periods when POST Luxembourg increased its postal tariffs. The average revenue per letter also continued to decline, falling from €0.88 to €0.85 at the end of 2024.

Parcel services totalled 19.33 million items, up 5.3% compared to 2023. The growth of the parcel services market is mainly driven by the continuous increase in inbound cross-border traffic, which recorded a 7.8% net increase, representing 82.8% of total parcel traffic or 16.01 million parcels. Revenue from parcel services showed stagnation, breaking with the growth trend observed since 2016.

Outbound cross-border traffic became more competitive in 2024, with revenue falling faster than volume. Parcel services represented 46% of total postal sector revenue, up by one percentage point. The average revenue per national or international parcel decreased from €11.46 to €10.64, while inbound cross-border parcels remained stable at €3.66. The Business-to-Business (B2B) parcel services segment had 30 providers, while the Business-to-Consumer (B2C) segment counted 31, with twelve active in both.

Moreover, the statistical report showed that subcontracting plays an important role in the postal services market, with almost 85% of total parcel traffic subcontracted to third-party service providers. Subcontracting mainly affects the cross-border parcel services market. According to the data collected, twelve service providers indicated that they use subcontractors, of which eleven are active in parcel services. The ten new providers registered with the ILR in 2024 operated exclusively as subcontractors.

The postal sector employed close to 2,250 people in 2024. POST Luxembourg alone employed almost 1,300 people, representing 57% of jobs in the sector.

Regarding access to postal services, 97 POST Luxembourg points of sale and 92 points of sale operated by eleven other providers were established on Luxembourg territory by the end of 2024. The number of POST Luxembourg automatic distribution points (Pack up) increased to 154 in 2024 (+13 since previous year). Mondial Relay, another parcel service provider active in the B2C and Consumer-to-Any (C2X) segments, opened fourteen automatic distribution points in 2024.

EO