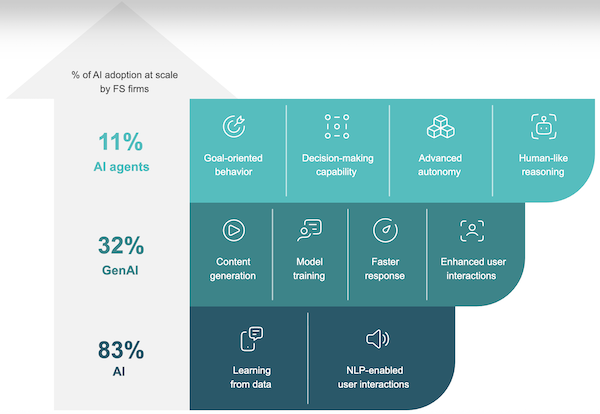

AI, GenAI and AI agent adoption among European financial services firms;

Credit: Capgemini Research Institute

AI, GenAI and AI agent adoption among European financial services firms;

Credit: Capgemini Research Institute

On Wednesday 12 November 2025, the Capgemini Research Institute released the results of its World Cloud Report in Financial Services 2026, revealing that financial institutions are increasingly relying on artificial intelligence (AI) agents to manage key customer-facing processes.

According to the report, banks and insurers are undergoing a rapid transformation in how they interact with customers by deploying AI agents for fraud detection, loan processing and customer onboarding.

Capgemini found that three in five banks and insurers identified customer onboarding as a leading reason for adopting AI agents. Among banks, 75% cited customer service, 64% fraud detection, 61% loan processing and 59% onboarding as the main areas of deployment. Insurers reported similar trends, focusing on customer service (70%), underwriting (68%), claims processing (65%), and onboarding (59%).

Researchers observed that AI agents could generate up to $450 billion in economic value by 2028. Currently, 33% of banks are developing AI agents in-house, while 48% of financial institutions are creating new roles for employees to supervise them. However, only 10% of firms have implemented these technologies at scale. Nearly two in three executives (61%) now identify cloud-based orchestration as critical to their AI strategy, transforming cloud platforms into innovation engines that can operationalize technologies at speed and scale.

Ravi Khokhar, Global Head of Cloud for Financial Services at Capgemini, stated: “The combination of AI and cloud allows banks and insurers to tap the power of AI agents to better serve their customers with greater precision, speed and impact. To realize this potential, financial institutions must take a long-term view as humans work alongside agents.” He added: “This means separating substance from hype. Leaders will need to consider how they can scale their agentic AI operation over time, with a vision of what they want their businesses to look like at the end of this process.”

According to the report, banking and insurance executives surveyed identified Know Your Customer (KYC), loan and claim processing and underwriting as the most inefficient business functions across the sector. They expressed optimism that AI agents can address these longstanding challenges, with real-time decision-making (96%), improved accuracy (91%) and faster turnaround times (89%) cited as key benefits.

The report also highlights that 92% of firms believe AI agents will help them expanding into new geographies, 79% see potential for dynamic pricing and revenue growth and 75% see an opportunity for delivering multilingual support that adapts to local regulations and cultural norms.

In the investment sector, senior executives are aligning their strategies with the growing potential of AI agents. The institute noted that nearly two in three leaders stated that up to 40% of their organisation’s generative AI budget is currently allocated to agent technologies, while one in four firms expect to increase their spending on such solutions by up to 60% by 2028.

Financial institutions also face significant challenges to large-scale AI adoption, including skills shortages (92%), regulatory and compliance burden (96%), as well as high implementation costs. To address these issues, some firms are exploring a “service-as-a-software” model within the next twelve to eighteen months. Rather than paying for licenses and infrastructure, firms will pay for outcomes such as fraud cases resolved, transactions processed or customer queries handled.

EO