Credit: BIL

Credit: BIL

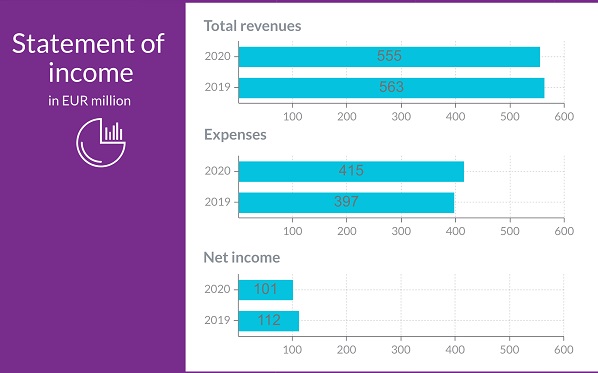

Banque Internationale à Luxembourg SA (BIL) announced today its financial results for the year 2020; the bank posted a net income of €101 (down 10% over one year).

In 2020, total revenues amounted to €555 million, down by €9 million (-2%) compared with 2019 (€563 million). The contribution of commercial activities to the core operating revenues increased by €3 million (+0.6%) compared with 2019. Throughout 2020, commercial activities were significantly impacted by the COVID-19 crisis. The lockdown period, travel restrictions and curfews reduced business development (particularly relevant at the level of Wealth Management) and transactional activities (payments and brokerage) for all business lines.

Customer loans increased by 4.8% to €15.4 billion mainly due to mortgage loans which grew by 15.2%. Customer deposits increased by 4.1% to €19.8 billion compared with €19 billion at year-end 2019, nuanced by an increase in current accounts as pandemic restrictions led to contracted client spending and investing throughout 2020.

The adverse macroeconomic outlook impacted all market participants, businesses and the banking industry. The core cost of risk totalled €63 million in 2020 compared to €27 million in 2019, largely influenced by the effects of the health crisis, thus significantly impacting 2020 net income.

At the end of 2020, BIL reported a net income of €101 million, showing resilience when compared with December 2019 despite the ongoing health crisis and the uncertain economic situation. During the general assembly held on 29 April 2021, the shareholders decided to allocate the 2020 net profit to retained earnings to support the bank’s development and invest in the future.

Investing for the future

2020 was a year like no other. Due to social distancing, BIL encouraged clients to use digital channels whenever possible to continue to access its services. It introduced new ways of working and ramped up home office capabilities for most employees and kept branches open to appointments with proper sanitary protection.

The pandemic has induced a deep global economic crisis. In this historically challenging time for clients, BIL continued to provide support to help people and businesses face the social and economic impacts of the crisis. The bank worked with the Luxembourg government to implement solutions to support the economy, such as loan deferrals and state-guaranteed loans. Over 2,800 loan deferrals were granted in 2020 and to date, a very large majority of these clients resumed the normal course of their payments.

2021: reconstruction for sustainable growth

In 2021, BIL has committed itself to continuing to support the economy as it is progressively improving.

Marcel Leyers, CEO of BIL, commented: “The Luxembourg economy is close to our hearts and I am proud we were able to contribute. I am very confident that our clients and our employees will benefit from our investments made in difficult times”.

The bank will continue to execute its strategic five-year plan "Create Together 2025", with the support of the majority shareholder Legend Holdings, as well as of Luxembourg. Growing its brand domestically and internationally, encouraging and supporting innovation and creating the conditions for sustainable growth remain top priorities.