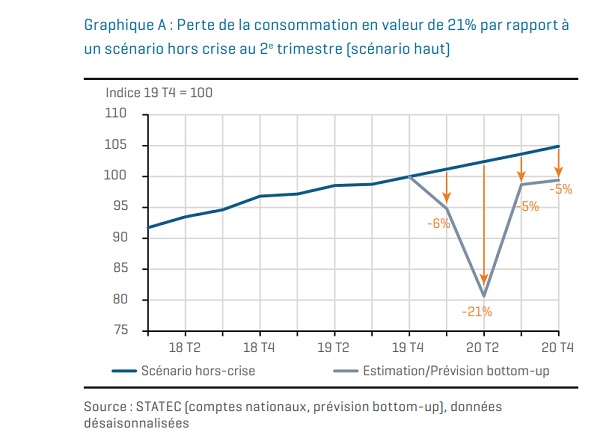

21% consumption loss in value compared to a non-crisis scenario in Q2 2020;

Credit: STATEC

21% consumption loss in value compared to a non-crisis scenario in Q2 2020;

Credit: STATEC

In its latest report, Luxembourg's national statistics institute STATEC has forecast a drop in consumption of 6% to 8% for 2020, largely due to the impact of lockdown measures on resident household consumption.

The consumption of resident households was strongly constrained by the first lockdown in sprin 2020. As such, STATEC forecasts a drop in consumption of up to 8% for 2020. That being said, the forced savings accumulated during lockdown constitute a significant potential for a rebound, the extent of which will depend on changes to consumer confidence.

The different sectors of consumption have been affected in a very different way by the pandemic and corresponding measures. Some consumer spending was hardly affected, such as rents and insurance costs, whilst others fell during the strictest phase of lockdown but, by their nature, displayed very diverse dynamics during deconfinement. This bottom-up estimate, established on a monthly basis, takes into account changes in restriction measures over time, divergent dynamics linked to the very nature of the expenditure and the respective shares of the various expenses overall.

The estimates and forecasts are based on different sources depending on the information available. The first estimates of the quarterly accounts give the profile of consumption over the first half of the year, while for the summer months, the bottom-up estimates are based more on monthly sources such as turnover. This information is combined and supplemented, especially for more recent months, by indications from the press, employers' organisations, similar evaluations made by institutes abroad, survey results and high frequency mobility data.

The consumption of resident households on which STATEC's study focusses has constituted over the last few years 30% of the GDP, a low rate compared to other countries (around 50% in neighbouring countries and the euro area as a whole). While the demand from other players weighs relatively more for certain sectors of activity in Luxembourg, other sectors depend directly on the final consumption of residents and non-residents alike, particularly retail trade and personal services.

According to its nature and the typre of restrictive measures put in place, the various areas of consumer spending have been affected differently by the health crisis. STATEC has distinguished three main categories of expenditure according to their trajectories: expenditure which has been affected very little, even during the strictest phase of lockdown, or even positively impacted; expenditure which was moderately or strongly impacted at the height of lockdown but has shown a clear rebound thereafer; expenditure which has been strongly impacted and in a lasting manner.

The first category applied to expenditure related to housing, communications and financial and insurance services. Moreover, spending on food in the retail trade even increased; following the temporary closures of restaurants and the increase in teleworking, these expenses were 3% higher in 2020 compared to a situation without a COVID-19 crisis, according to STATEC's estimates.

The second category applies mainly to goods sold in stores that were closed during lockdown (because they were deemed non-essential) and whose consumption could be postponed. Durable goods such as furniture, household appliances, audio / video equipment and cars, sales are expected to have benefited from a catch-up, exceeding at least temporarily, over the summer months, the levels expected in the absence of crisis. However, this catching-up should still remain largely too weak to erase previous losses. In view of the turnover observed in retail trade across Europe, the rebound seems to have been more gradual for clothing (still around -10% compared to pre-crisis levels in August) than for the goods mentioned above.

The third and final category defined by STATEC applies mainly to services requiring physical social interaction, such as those provided by the hotel and catering industry, cultural and sporting services as well as transport services and travel activities. The reduction in spending is explained by measures to contain the virus (closures, schedule changes, social distancing, cross-border travel restrictions), but also by consumer reluctance. These expenditures are likely to be disrupted until the end of the health crisis, that is, until an effective vaccine or treatment becomes available on a large scale. Fuels are an example of a good whose consumption was greatly reduced during lockdown and which will not be compensated (nor will it recover) afterwards. Following the prolonged use of teleworking and the fall in oil prices, fuel expenditure is not expected to return in the short term to levels that would have been observed in a non-crisis scenario.

In total, the loss of consumption compared to a “normal” situation (a scenario outside the crisis) is expected to amount to 9% in value for 2020. Compared to 2019, this spending is expected to decline by around 5% in value (and just over 6% in volume).

In the second quarter, the loss of consumption compared to the “normal” situation is expected to be the most significant, down 21% (down 35% in March, down 21% in April and then down -9% in June, reflecting the gradual deconfinement). The loss is expected to be limited to 5% in the third quarter following the increased consumption of certain goods (catch-up effect) and the more or less gradual normalisation of other affected expenditure. Quarterly growth should jump to over 20% in the third quarter, after dropping by around 15% in the second and 5% in the first quarters (in value).

The improvement is expected to slow down in the fourth quarter (still a loss of 5% compared to a situation without a crisis) due to a slight increase in COVID-19 infections and the dissipation of certain catch-up effects.

STATEC's report concluded that the accumulation of forced savings combined with unmet needs in 2020 and the prospect of a vaccine argue for a strong increase in consumption in 2021 or 2022. This presupposes that household confidence continues to recover and that the loss of disposable income due to the crisis remains limited. In the event of a less favourable scenario, with a strong resurgence of infections and a strengthening of health measures at the end of 2020 and the beginning of 2021, the risk that consumers anticipate a deterioration in the labour market increases. This would affect their income and expenditure outlook. In this case, the accumulated savings, instead of fueling consumption, would rather turn into precautionary savings.