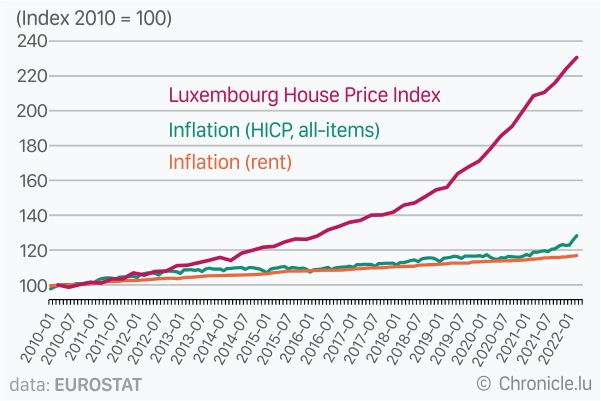

Data extracted from the European statistics agency Eurostat shows that house prices in Luxembourg in the first quarter of 2022 have increased 131% compared to 2010, while the annual inflation rate with respect to the Harmonised Index of Consumer Prices (HICP) increased only marginally, up 28% in the same period.

Both the house price index (HPI), the index measuring annual changes in the transaction prices of residential dwellings purchased by households, and HICP, which measures the annual increase in prices of the total household consumption across the Grand Duchy, were established to equal to 100 for 2010 (index 2010 = 100) for comparison purposes between the two indices.

Analysis of the data showed that house prices (HPI) systematically outpaced overall consumer price increases (HICP) and even increased in pace since 2019 while, in comparison, the annual rate of change in rental prices (rent inflation, index 2010 = 100) remained more or less similar to that of HICP.

Across the European Union (EU), house prices (HPI) were on average up 44.7% and rents increased by 16.9% in the first quarter of 2022 compared to 2010 while, in the recent annual change, i.e. compared to 2021 Q1, prices were up 10.5% and 1.4%, respectively.

Between 2010 and 2022 Q1, HPI increased more than rent increases in nineteen EU Member States. Notably, seven Member States witnessed house prices increasing more than double (over 100%) since 2010, namely in Estonia (174%), Hungary (152%), Luxembourg (131%), Czechia (121%), Latvia (119%), Lithuania (117%) and Austria (114%). Excluding Greece (down 22.6%), Italy (down 10.4%) and Cyprus (down 7.9%), all remaining 24 EU Member States recorded an increase in house prices since 2010.

In terms of rents, prices increased in 25 EU Member States over the same period. The highest rises were recorded in Estonia (up 178%), Lithuania (up 127%) and Ireland (up 77%), while rents decreased in Greece (down 25%) and Cyprus (down 1%).

In analysis of the housing market, taking out the annual increases in consumer prices (HICP) from the HPI essentially offers a key insight, wherein too high a growth rate of this adjusted HPI, also known as the deflated HPI, is generally considered an early warning of tensions in the real estate market - signalling the risk of price bubbles.

While a deflated HPI of over 6% is considered as an alarm threshold, in 2021, the highest adjusted HPIs were recorded in Czechia (up 16.4%), Luxembourg (up 11.2%) and the Netherlands (up 11.2%). Luxembourg also recorded an adjusted HPI of 13.8% in 2020, the highest in the EU.

Across the EU, data showed that, between 2016 and 2021, every year house prices increased more than the HICP inflation rate in 24 to 26 Member States.