Credit: © Jones Lang Lasalle IP, Inc. 2025

Credit: © Jones Lang Lasalle IP, Inc. 2025

On Wednesday 23 July 2025, real estate services company JLL took stock of Luxembourg's office market for the first half of 2025.

After more than two lean years, signs of recovery are multiplying in the Luxembourg office market, according to JLL. The company said its most encouraging finding is that the private sector is driving the recovery, rather than numerous transactions by government occupiers.

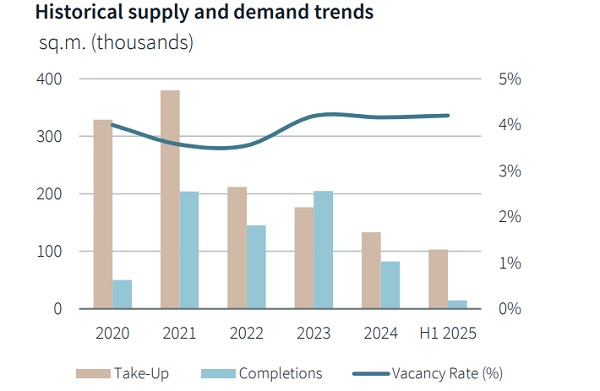

JLL noted that project-oriented activity continued to dominate the Luxembourg office market. New buildings contributed significantly to generating a robust take-up of 63,785 m² in the second quarter, a significant increase of 63% compared to the first quarter of 2025 and 148% year-on-year. Take-up since the beginning of the year thus reached 102,970 m², exceeding the figures for the first half of 2024 by 104%.

The share of Grade A buildings, i.e. those less than five years old or under construction, reached 71% of the transaction volume for the past half-year. For comparison, the annual average for the share of Grade A buildings in total occupancy was 67% over the previous five years.

Notable transactions in the second quarter of 2025 included: JP Morgan, which secured 13,975 m² in Gio's The Waves project in Kirchberg; PwC, which leased 9,500 m² in Nextensa and Grossfeld's Eosys project (Cloche d'Or); and Baker McKenzie, which acquired 2,640 m² in Iko's Ekxo project (Cloche d'Or).

Vacancy rates remained relatively stable at 4.2%, up slightly from 4% in the previous quarter, but unchanged from the end of 2024. In absolute terms, 194,628 m² are currently vacant, with JLL attributing this moderate increase mainly to new deliveries in central districts. Given the strong pre-leasing performance since the beginning of the year, JLL's vacancy forecasts have become more optimistic, although the company still anticipates a slight upward trend.

Construction activity stood at 515,514 m², of which 72% was already pre-let. Approximately 58,382 m² is expected to be speculatively completed in the second half of 2025, 29% of which is located in central districts.

Prime rents remained stable at €54 per m² per month (excluding VAT) in the Boulevard Royal area of Luxembourg City. However, the Gare district experienced rent growth of 7.5% owing to lettings in Iko's Unicity project. JLL said it also expects rents to rise in Kirchberg and Cloche d'Or. Average rents across the city, however, remained stable at €32.90 per m² per month.

Investment activity in the second quarter included both core transactions and purchases for own use. In a notable core transaction, JLL advised on the sale of the renovated Vertbois building in Kirchberg (leased to Julius Baer) to a family office. Earlier in the year, JLL also advised on the sale of the Charlotte building in Luxembourg City, also to a family office. Office investment volume in the first half of 2025 reached approximately €274 million, substantially exceeding the €193 million recorded in the first half of 2024. JLL said it was seeing a cautious return of investors, which it described as a first step towards recovery.

Prime office yields remained unchanged compared to the first quarter at 4.50%.

Emna Rekik, Country Lead and Head of Markets at JLL Luxembourg, summarised: "The positive momentum we are observing in the first half of 2025 is a particularly encouraging signal for our Luxembourg real estate ecosystem. What pleases me is to see the private sector resuming its role as a growth engine with a doubling of occupancy. The stability of vacancy rates and the gradual return of investors to core assets demonstrate a tangible renewed confidence. This recovery, driven by ambitious and sustainable projects, positions Luxembourg as a resilient and attractive market in a still uncertain European context."